No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

In a ground-breaking legal development, the Nagpur Bench of the Bombay High Court has made a resounding decision. The Court has nullified the CP Rules, the Selection Committee, and the examination conducted for the selection of Presidents and Members of District and State Commissions. As a result, the 112 appointments of Presidents and Members to these commissions, made by the Maharashtra Government just two weeks ago, have been invalidated.

However, on a more global stage, India’s Unified Payments Interface (UPI) is asserting itself as a key player in strengthening international relationships, particularly with countries like Singapore and the UAE. Jay Shambaugh, the Under Secretary of the US Treasury for International Affairs, has highlighted the proactive efforts of ASEAN countries to integrate their fast payment systems and transition to the ISO 20022 messaging standard.

India is notably at the forefront in fostering bilateral connections between its UPI system and those of other nations. The G20 Payments Roadmap is driving the expansion of payment system connectivity on a global scale. Shambaugh has also drawn attention to ongoing experiments in cross-border central bank digital currencies (CBDCs) and payment systems built on distributed ledger technology.

Shifting gears to domestic affairs, India has experienced a remarkable drop in urban unemployment, with the rate decreasing from 7.6% in the previous year to 6.6% in the second quarter of 2023. This positive trend is credited to the easing of Covid-related restrictions. Notably, data also reveals an uptick in the labor force participation rate, although challenges remain in enhancing female workforce participation.

Lastly, an exceptional milestone has been reached in India with the installation of the first-ever BSNL BTS (Base Transceiver Station) in the Siachen region. Situated at an altitude exceeding 15,500 feet, Siachen is the world’s highest battlefield. This achievement empowers soldiers to maintain crucial communication with their families while serving in this extreme and remote environment.

We extend our profound gratitude to our esteemed readers for their unwavering support. Your encouragement has been instrumental in delivering informative articles. We encourage you to stay engaged, share your feedback, and look forward to our upcoming content, covering a wide array of topics. We eagerly await your ideas and suggestions, which can be shared with us at info@consumer-voice.org. Let’s collaboratively foster a knowledgeable and empowered community.

We wish you an enjoyable reading experience ahead!

Pallabi Boruah

Editor

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

An Equity Linked Savings Scheme (ELSS) is a mutual fund scheme primarily focused on investments in equity and equity-related securities. ELSS funds are strategically structured to enable investors to reduce their tax liabilities under Section 80C of the Income Tax Act in India. In this article, we will provide an extensive examination of ELSS mutual funds.

Subas Tiwari In comparison to Fixed Deposits or the National Pension Scheme (NPS), Equity Linked Saving Scheme (ELSS) provides numerous tax-saving benefits while also delivering higher returns. Mutual funds, including ELSS, typically yield greater returns than FDs or NPS. Consequently, individuals who invest in ELSS funds or equities tend to regard ELSS as a more effective option.

Imagine the advantages of accumulating funds while also enjoying a substantial tax exemption. Tax exemptions essentially translate to savings, which can then be strategically allocated to other financial objectives. A similar program, known as Equity Linked Saving Scheme (ELSS), allows individuals to save up to Rs. 46,800 in taxes.

ELSS is an investment fund that offers optimal returns within a minimal lock-in period. It is predominantly composed of stocks from large and medium-sized companies. ELSS has been thoughtfully structured to simplify tax-saving for investors. Over an extended holding period, it presents significant potential for growth and enhanced returns. This fund boasts various appealing features; for instance, you can initiate investments with as little as Rs. 500, and it accommodates systematic investment plans (SIPs). The fund comes with a minimum lock-in period of 3 years, meaning you can easily exit the fund and access your funds after this period. The most noteworthy feature is that this fund empowers taxpayers to potentially save up to Rs. 46,800 in taxes.

There is a specified range for the minimum deposit amount in this tax-saving fund. In this particular fund, you can commence your investment with as little as Rs 500, and the upper limit for your deposit is capped at Rs 1, 50,000. Your earnings from this fund are contingent on both your deposit amount and the prevailing market conditions. Considering the performance over the past year, it has been promising, with mutual funds, as well as equities, delivering favourable returns.

Indeed, an Equity Linked Saving Scheme (ELSS) is a tax-saving fund that predominantly allocates its funds to equity schemes. Equity funds are investment schemes that channel funds into the shares of various companies. The selection of companies for investment is typically based on their market capitalization, and the fund’s assets are distributed among these companies. If an individual consistently invests Rs 1.5 lakh in an ELSS every year, they can avail a tax saving benefit of up to Rs 46,800 under section 80C of the Income Tax Act. It’s important to note that while the tax benefit is capped at Rs 1.5 lakh, you are indeed allowed to invest more than this amount in ELSS if you choose to do so.

ELSS is considered to be much better than those who follow the traditional methods of tax saving. Compared to Fixed Deposit or NPS, ELSS offers many tax saving facilities along with giving higher returns. Mutual funds earn more than FDs or NPS. Therefore, people who invest in ELSS funds or equities consider ELSS to be more effective. The biggest thing is that the lock-in period of ELSS is very less as compared to FD or NPS. That is, the possibility of high returns in a short time can be found in ELSS.

ELSS can be invested by any person who wants to reduce his income tax under section 80C by investing money in tax saving scheme. It is an equity investment, so those who invest money for a long term and expect returns, who are less concerned about market risk, can make the most of this fund. Since ELSS has a lock-in period of 3 years, the fund is taxed on the basis of long-term gains. If earning more than Rs 1 lakh then interest of 10% will have to be paid.

You don’t have to contribute a substantial amount of money all at once to participate in this fund. You needn’t worry about having to make a large initial deposit to benefit from this tax-saving program. You can join this scheme with a minimal investment. By averaging your contributions to this fund every year, you can start your investment journey with the same amount of money. You’re not required to make substantial payments per unit of the fund. If you prefer, you can begin your investment with as little as 500 rupees, and this approach also fosters a disciplined investment strategy.

ELSS is a mutual fund scheme & is quite similar to diversified equity fund of Mutual Fund. As the name suggests, the scheme primarily invests in equity market by buying equity stocks of companies listed on the stock exchanges. The units of the scheme are offered at the NAV (Net Asset Value). The NAV is announced for all business days and keeps changing primarily depending upon the movement in the prices of stocks held in the portfolio of the scheme in relation to market fluctuations. Mutual Fund ELSS is a good tax-saving instrument but still is not invested in large numbers by tax-savers. So, this article is just to wake them up & take notice of this tax-saving investing option so that there is maximum participation of the public from all walks of life.

It is most likely that the Direct Tax Code (DTC) proposed by the Government will come into effect (sooner than later), and your most dependable tax saving section – Section 80C of the Income Tax Act would undergo amendments. While the DTC includes a proposal to increase the eligible deduction under Section 80 C, Equity Linked Savings Schemes (ELSS) -also known as ‘tax saving mutual funds’, would no longer continue to be a part of eligible tax saving instruments, thus leaving you with fewer market-linked investment options to accelerate the process of wealth creation.

YES. This is an important aspect of tax-planning especially when you look at ELSS as a tax-saving option. The following are the factors that could be considered.

If you have financial goals set in your life, the same too should influence the way you do your tax planning and invest in tax saving instruments. So, say for example your goal is retiring from work 5 years from now, then your tax saving investment portfolio should be less tilted towards market-linked tax saving instruments, as you are quite near to your goal and your regular income will cease. Likewise, if you are many years away from the financial goal, you should ideally allocate maximum to market-linked tax saving instruments and less towards those instruments (tax saving) which provide you assured returns.

It refers to your ability to take risk while investing, and it is totally dependent on your age, income, expenses, and nearness to your goal. So, if your willingness to take risk is high (aggressive), you can tilt your tax saving investment portfolio more towards the market-linked instruments such as ELSS. But if you have a moderate-risk profile, then you can take a mix of 60:40 into market-linked tax saving instruments and assured return tax saving instruments respectively.

Thus, now if you are young, income is higher, and therefore willingness to take risk is highest along with your financial goals being far away; you may look at ELSS mutual funds to avail a tax benefit under Section 80C. Please note that ELSS mutual funds are 100% diversified equity funds and a distinguishing feature about them is the compulsory lock-in period of 3 years brings in financial discipline towards holding one’s investments for the long-term. For investment in ELSS, there is a minimum investment amount of Rs. 500 which is unlike the other equity-oriented funds (which generally demand Rs. 5,000 as the minimum investment amount).

It is said that if your income is high, your willingness to take risk is generally high. This can work in your favour, as you can allot your portfolio more towards equity-related instruments such as ELSS, and make your portfolio appear more aggressive. Similarly, if your income is not high enough, you can invest in other tax-saving instruments which provide you assured returns.

Your age should determine your asset allocation. If you are young, you can take more risk and vice-versa. Hence, for prudent tax planning too, if you are young, you should allocate more towards market-linked tax saving instruments such as ELSS. Moreover, you would also enjoy the advantage of greater investment tenure which would enable you make more aggressive investments and create wealth over long-term to meet your financial goals.

Ideally while evaluating ELSS mutual funds, one should assess their performance over a 3-year time frame, as this would enable you to judge whether they have created wealth for your post- lock-in period.

Moreover, the fund has to ensure to its investors to fairly low-risk, but should provide risk-adjusted returns thereby making it a low risk-high return investment proposition in the category. Also, the returns should have been achieved by the Fund without indulging in much portfolio churning.

Tax benefit on the Investment

You can get full tax benefit of investment under section 80 C of Income Tax Act. Maximum taxable limit is Rs. 150000 for the current Assessment Year.

Lock-in period of ELSS is 3 years which is shortest in comparison to any other tax saving investment. This lock-in period is the only difference between diversified equity mutual funds & ELSS. When compared to Bank tax-saving FDs, ELSS scores over them as Bank FDs have a lock-in period of 5 years.

Tax-free returns

Any profit/ capital gain you have from ELSS is completely tax free. If you compare the returns from NSC & Tax-Shield Bank FDs, these are completely taxable & paid interest is added to your income for tax computation. So, you end up paying tax on interest received. Only PPF offers tax- free returns but it has a maturity period of 15 years.

Tax free dividends

ELSS schemes give dividends on regular intervals and the dividend you receive is tax free.

No entry loads

Say if you invest Rs. 15000 in ELSS Scheme, your Rs. 15000 is invested in ELSS Mutual Fund. You have to decide how much want to pay your financial advisor. Take a word of caution: some insurance agents sell ULIPS as Mutual Fund + Insurance with lots of ‘load’ expenses.

High growth

Equity funds can be volatile in the short run, but have been known to beat inflation and create wealth over the long run. If you are looking at investing some money that you won’t need in future, and are willing to stand atop the ups and downs of the market, you may find ELSS an ideal tax saving option.

Systematic Investment Plan (SIP) in ELSS

In SIP, you invest a certain amount each month in a fund. It’s an effective way of investing in ELSS as the concept of rupee cost-averaging and the power of compounding works well. Even if you have done your tax planning for this year, start from 1st AUGUST, 2015.

Comparison with Unit-Linked Insurance Plan

The investors & tax-saving public sometimes think of ELSS funds and ULIPs as alternatives. This is a mistake as functionally, there is nothing common between ELSS funds and ULIPs. It’s a basic rule of saving to not mix up insurance and investments. ELSS and ULIPs are two different products that serve different purposes.

| COMPARISON OF ELSS WITH ULIP | |

| ELSS | ULIP |

| ELSS is an equity fund in the market | ULIP is a mix of life insurance and investment offered by life insurance companies |

| ELSS have a predictable cost, and easily understandable returns and are transparent about how the fund operates and what it invests in | From the premium paid, the insurer deducts charges towards life insurance (mortality charges), administration expenses and fund management fees. So only the balance amount is invested |

| Only payment of fund management charge (as expenses) per year is applicable | ULIPs have high first year charges towards acquisition (including agents’ commissions) |

| The total investment under ELSS is in Equity Funds only | In a ULIP, the mix of investment and insurance prevents savers from having a clear cost-vs-benefit understanding of either of the two components |

| In ELSS, there is no fixed period of maturity except for the lock-in period as the fund is open-ended | With an ULIP, you have to block your money for long periods of time. So, you sacrifice on transparency and liquidity |

| ELSS has a 3 years lock-in period | ULIPs have a 5 years lock-in |

| ELSS has no switching facility of funds as it is controlled by the fund manager |

ULIPs provide for ‘switch’ from one fund to another |

ELSS stands out as a favored tax-saving choice for savvy investors. It not only offers diversification through its equity investments but also comes with a relatively short lock-in period of just 3 years from the date of investment. The returns generated from ELSS investments are closely tied to the performance of equity markets. Furthermore, the returns from ELSS schemes are tax-free.

In recent years, some of these funds have demonstrated exceptional growth, multiplying in value by three times within a 5-year period. It’s worth noting that there is no specific limit on the amount you can invest in ELSS funds. However, you can claim a tax deduction of up to Rs. 1,50,000 under Section 80C of the Income Tax Act.

It is always better to invest-

ELSS (Equity Linked Savings Scheme), NPS (National Pension System), and PPF (Public Provident Fund) are all popular tax-saving investment options in India. Each of these options has its own set of features, benefits, and limitations. Here’s a comparison of ELSS, NPS, and PPF to help you make an informed decision:

ELSS: ELSS is a mutual fund scheme primarily investing in equities. It aims for capital appreciation and carries market-related risks.

NPS: NPS is a retirement savings scheme that allows you to invest in various asset classes, including equities (up to 75% of the contribution in Tier I account). It is designed for building a retirement corpus.

PPF: PPF is a long-term fixed income investment scheme offered by the government. It offers a fixed interest rate and is considered a safe investment option.

ELSS: ELSS has a lock-in period of three years, which is the shortest among the three options.

NPS: NPS has a lock-in period until retirement (with some exceptions). Partial withdrawals are allowed under specific circumstances.

PPF: PPF has a lock-in period of 15 years, but it can be extended in blocks of five years indefinitely.

ELSS: Investments in ELSS are eligible for a tax deduction under Section 80C of the Income Tax Act, up to ₹1.5 lakh per financial year. However, returns from ELSS are subject to long-term capital gains tax.

NPS: Contributions to NPS enjoy tax benefits under Section 80CCD (1) and Section 80CCD (2) of the Income Tax Act. However, there are restrictions on withdrawals, and the maturity amount may be partially taxable.

PPF: PPF investments and interest earned are both eligible for tax deductions under Section 80C. Additionally, PPF returns are tax-free.

ELSS: ELSS investments carry market-related risks. Returns can be higher but are subject to market fluctuations.

NPS: NPS offers a mix of asset classes, including equities, which can provide potentially higher returns than PPF but with some risk.

PPF: PPF offers fixed, guaranteed returns. It is a low-risk investment but typically provides lower returns compared to ELSS and NPS.

ELSS: Offers flexibility in terms of investment amount and frequency (through SIPs). Post-lock-in, you can redeem or switch your investments.

NPS: Provides flexibility in asset allocation and contribution amount. It is designed for long-term retirement planning, so withdrawals are restricted.

PPF: Offers flexibility in terms of contribution amounts and frequency but has a long lock-in period.

ELSS: Primarily used for wealth creation and tax-saving goals.

NPS: Designed for long-term retirement planning and building a retirement corpus.

PPF: Suited for long-term savings, particularly for conservative investors.

ELSS: Becomes liquid after the three-year lock-in period.

NPS: Generally, not liquid until retirement, with some exceptions.

PPF: Offers partial withdrawal options from the seventh year onwards.

The choice between ELSS, NPS, and PPF depends on your financial goals, risk tolerance, and investment horizon. Many individuals opt for a combination of these investment options to balance risk and returns while achieving their financial objectives. Consulting a financial advisor can help you create a tax-efficient and diversified investment portfolio based on your specific needs and circumstances.

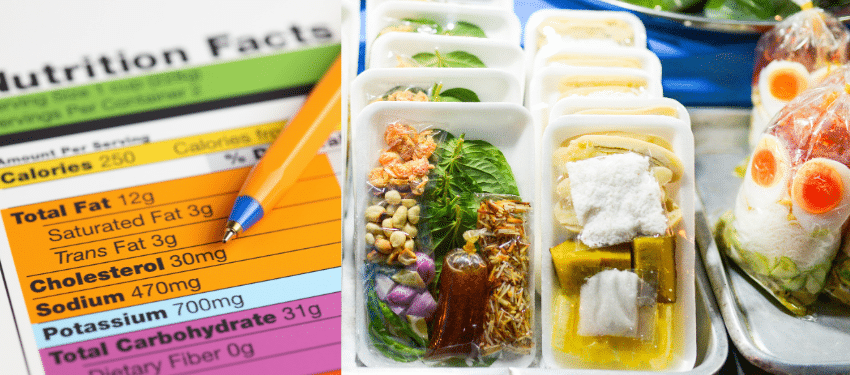

In a bustling world filled with convenience and fast-paced lifestyles, packaged foods have become an integral part of our daily lives. These neatly wrapped treasures line the shelves of grocery stores, providing us with a myriad of options to satisfy our hunger and cravings. From the breakfast cereals that jumpstart our mornings to the frozen foods that save us from kitchen disasters, packaged foods have infiltrated our daily routines. However, amidst the convenience lies a crucial aspect that often goes unnoticed—the information displayed on the packaging. Taking a moment to read and understand the details on packaged foods can empower us to make informed choices about what we consume, paving the way for healthier lifestyles and a greater understanding of the impact our food choices have on our bodies and the world around us. Let’s delve into the details on labels, ingredients, and nutrition facts to guide our decision-making towards informed food choices.

Richa Pande

Understanding the nutritional value of the foods we consume is a crucial step towards a healthier lifestyle. At the heart of deciphering this information lies the nutrition facts label, a goldmine of essential data. This label is like a map that guides us through the nutritional content of the product, from calories to fat, carbohydrates, protein, and more. By reading and interpreting this label, we gain valuable insights into the components of our food and can make informed dietary choices. For instance, if we’re aiming to reduce our sugar intake, checking the label can help us identify added sugars in our favourite snacks. Moreover, being aware of the serving size and the number of servings per container aids in portion control, preventing us from overindulging and managing our caloric intake effectively. Reading the nutrition facts label also allows us to be more mindful of the essential nutrients our bodies need. Armed with this knowledge, we can make informed food choices.

Having a comprehensive understanding of food additives is crucial for making well-informed decisions. Food additives are substances added to food products to enhance their appearance, flavour, texture, or shelf life. Some commonly used additives include emulsifiers, stabilizers, colorants, and flavour enhancers. They are often assigned E numbers for identification purposes. For instance, E322 represents lecithin, an emulsifier commonly found in processed foods. While many additives are considered safe, some have been linked to health concerns. For example, certain artificial food colorants, such as E102 (tartrazine) and E129 (Allura red), have been associated with allergic reactions and hyperactivity in sensitive individuals, particularly children. Similarly, preservatives like sodium nitrite (E250) used in processed meats have been linked to an increased risk of certain cancers. Given these considerations, making choices aligned with personal health preferences becomes vital. Opting for natural alternatives and whole foods can help minimize exposure to potentially harmful additives. Checking food labels and understanding the ingredients listed can empower us to make informed decisions like opting for foods with safer alternatives.

Ingredient lists play a crucial role in helping people with specific dietary needs or restrictions navigate the food landscape. When reading product labels, it is important to check the ingredients list thoroughly. The ingredients are usually listed in order of predominance, meaning the ones used in the greatest amount are listed first, followed by those in smaller amounts. This can provide valuable information about the composition of the product and enable informed choices.

Allergen and intolerance warnings on food labels are vital for individuals with allergies. They help identify potential triggers and prevent adverse reactions. For example, an aspartame warning is crucial for those sensitive to this artificial sweetener, while dairy warnings help lactose-intolerant individuals avoid discomfort. Peanut warnings protect those with severe peanut allergies, while gluten warnings cater to individuals with celiac disease. These clear and informative labels empower individuals to make safe choices, ensuring they steer clear of allergens and intolerances and maintain their health and well-being.

Checking and following storage and preparation instructions is important to ensure proper handling and cooking of food, minimizing the risk of foodborne illnesses. These guidelines typically cover aspects like hand hygiene, proper food handling, cooking temperatures, and avoiding cross-contamination.

In India, motorcycles and scooters, which are two-wheeled vehicles, enjoy widespread popularity as a cost-effective and convenient means of transportation. Nevertheless, operating a two-wheeler entails inherent hazards, such as accidents, theft, and physical harm. In order to safeguard against these perils and adhere to legal mandates, acquiring a two-wheeler insurance policy is of utmost importance. This article delves into the various aspects of 2-wheeler insurance policies in India, including their types, coverage options, benefits, and regulatory requirements.

Subas Tiwari

Bike insurance in India comprises two main categories: Third Party Liability Insurance and Own Damage Insurance. Third Party Liability Insurance provides coverage when your bike causes damage to another vehicle. On the other hand, Own Damage Insurance, often referred to as OD insurance, comes into play when your own bike sustains damage, including situations involving theft, where the insurance company provides compensation. It’s essential to note that Third Party Liability Insurance, or TP insurance, is mandated by the Motor Vehicle Act and is a legal requirement. Failure to possess this policy may lead to traffic police issuing a traffic violation ticket, commonly known as a challan.

In the event that your motorcycle results in property damage, damage to another vehicle, injury to individuals, or loss of life in an accident, your insurance policy covers all associated legal expenses. This means that if the matter escalates to a court proceeding and you are required to pay fines, your insurance provider will cover those costs. There is a maximum limit of Rs 7,50,000 specified by the insurance company for this coverage.

Within third-party insurance, there is a segment known as ‘Personal Accident Cover for the owner and driver.’ In the unfortunate event that the motorcycle driver, who possesses a valid registration certificate and a driver’s license, loses their life in an accident while operating the bike, the insurance company provides a compensation of 15 lakh rupees. This compensation is provided in the form of a personal accident cover. There are specific guidelines and procedures for claiming this compensation from the insurance company, which can be readily pursued by the family of the vehicle owner.

During Comprehensive Insurance, companies provide many types of add on benefits, in which case you can choose it according to your need. In this, you will get the facility of zero depreciation cover, engine and gearbox protection cover, key and lock replacement cover, helmet cover, 24 × 7 site assistance add-on, etc.

Opting for an extended insurance policy not only allows you to enjoy some cost savings but also relieves you of the annual renewal hassle. Additionally, it enables you to avail the no-claim bonus over the policy’s duration, even if you have made a claim within that timeframe.

Look into these statistics and realize the importance of insurance

Chapter XI of the MV Act, 1988 deals with Insurance of Motor Vehicles with Third Party Risk & Clause 146 deals with ‘necessity of for insurance against third party risk’.

Currently, the Motor Vehicles Act stipulates that all two-wheelers must have insurance coverage for third-party liability. This coverage encompasses the responsibility for injuries and damages inflicted upon others, who are referred to as the third party. In this context, the first party is the vehicle owner, and the second party is the insurance company. This insurance, often known as Limited Liability Insurance, provides protection to the insured party, including the owner and the driver of the two-wheeler or pillion rider, against any third-party liability resulting from an accident. This liability covers damages or losses incurred by the third party or their property, as well as the owner/driver’s disability or loss of life resulting from the accident. However, the premium for third-party liability coverage is determined according to the regulations set forth by the Insurance Regulatory and Development Authority (IRDA).

While MV Act does not provide for covering insurance for other types of risks like, theft, fire, etc., as also damage to the owner’s vehicle, almost all the general (non-life) insurance companies are offering the Comprehensive Cover as an Optional cover, which is not mandatory.

The comprehensive cover (also called Package Policies) assures the following benefits-

The following additional covers are available on payment of extra premium-

Having a 2-wheeler insurance policy offers several benefits to policyholders:

Several factors influence the premium of a 2-wheeler insurance policy:

|

Company Name |

IDV |

Yearly Premium |

|

Liberty Insurance |

44853 |

4426 |

|

Bajaj Allianz General Insurance |

55927 |

4519 |

|

United India Insurance |

54595 |

4038 |

|

Digit Insurance |

46750 |

4331 |

|

Magma HDI |

52696 |

4751 |

|

Chola MS General Insurance |

47823 |

4177 |

|

HDFC Ergo |

57285 |

4438 |

|

Future Generali |

47824 |

4178 |

|

New India |

50666 |

4202 |

Quotes taken from: https://www.insurancedekho.com

When an insured event occurs, policyholders must follow a specific process to make a claim:

Grievance Redressal Mechanism

Our study revealed that only a few insurance companies have posted a robust GRM system in their website. So, they are summarized below for our readers.

What is your grievance?

IRDAI’s Integrated Grievance Management System (IGMS)

The Insurance Regulatory and Development Authority of India (IRDAI) has implemented the Integrated Grievance Management System (IGMS) as an online platform that enables policyholders to officially lodge their complaints against insurance companies. Through IGMS, policyholders have the capability to monitor the progress of their grievances and engage in direct communication with IRDAI.

What can the government do?

Conclusion

2-wheeler insurance policies play a critical role in ensuring financial security for two-wheeler owners in India. Whether you opt for mandatory third-party liability coverage or comprehensive insurance with a range of add-ons, having the right insurance policy is essential to protect your bike and yourself from unexpected events.

As a responsible bike owner, it’s essential to understand the types of coverage, factors affecting premiums, and the claim process. Additionally, regularly renewing your policy ensures uninterrupted coverage and may also lead to valuable discounts through the No Claim Bonus (NCB) system.

To sum it up, two-wheeler insurance represents a judicious investment to protect your motorcycle and offer you a sense of security as you navigate the streets of India.

Things You Must Know About a Lapsed Two-Wheeler Insurance Plan

As we all know, two-wheeler insurance is mandatory for every two-wheeler being ridden on the road in India, and riding your vehicle without insurance is not at all advisable or legal, for that matter. Hence, it is recommended to purchase and renew your bike insurance on time.

Two-wheeler insurance can be easily renewed online, saving you from the hassle of visiting the insurer’s branch office. There is a grace period of 90 days, wherein the insurer can create the policy as a break-in so that you can still retain certain benefits like NCB. However, after this 90-day period, you will have to buy a new policy and start over with no benefits.However, we often miss out on renewing insurance on time.

However, that doesn’t mean that you cannot revive your two-wheeler insurance policy.

What happens when you fail to renew on time?

A policy lapses when you do not pay the premium to renew the policy on time. Consequently, there are no benefits within the break-in period i.e., the time period when the old policy has expired and the new policy is still to come in effect.

The No Claims Bonus (or NCB) which you may have accumulated with your bike insurance over the years will be lost if the policy is allowed to lapse for more than 90 days, which includes up to 50% discount which stacks up under the NCB benefit. And obviously, this may result in a higher premium on renewal. Additionally, you will be unprotected against any damage or loss arising out of an accident and related third party liabilities. Therefore, the best way to keep such a scenario at bay is to renew your policy on time. In that regard, you can save both money and time by renewing bike insurance online.

How can you reinstate your lapsed policy?

Do note that you cannot renew a lapsed policy after 90 days. In scenarios like those, you have to buy a new policy that would require the necessary documentation and inspection of the vehicle, among other formalities.Renewing your two-wheeler insurance is mandatory, as riding a vehicle without insurance is an offense that is punishable by law. Owing to the convenience associated with renewing your bike insurance policy online, the whole process has now become easier.

What to do if your two-wheeler insurance has expired?

Insurers do remind customers through reminder texts or calls when the policy expiry date is near. But there can be certain situations when you miss out to renew on time. If you have lost track of your policy renewal date or have missed it, the first step to undertake is to call up your insurer and ask for assistance. Your insurer may renew your policy without any penalty if it is only a few days past the due date. Moreover, insurers don’t undertake inspection in cases where you have been trying to pay for the policy before it expired.

Renew your existing policy online or offline

When renewing your lapsed policy, you can do it online as well as offline. For the online mode, you can visit the insurer website, enter the required details and renew your policy online. While renewing online, keep all the vehicle documents handy as you will be required to enter the details. If you renew offline, you will have to visit your insurer, and he may ask a survey of your vehicle before issuing a new policy.

How to avoid lapses in insurance renewal?

The best way would do would be to renew on time. It is easy to keep track of the due date by signing up for email/SMS alert service. However, there is another smart way to avoid these hassles; just opt for a long-term two-wheeler insurance policy. Some insurers offer long-term insurance policies with coverage of up to 3 years. Choosing a long-term two-wheeler insurance policy saves you from the hassles of annual renewals while offering tangible benefits.

Grievance Redressal Mechanism

Our study revealed that only a few insurance companies have posted a robust GRM system in their website. So, they are summarized below for our readers.

What is your grievance?

IRDAI’s Integrated Grievance Management System (IGMS)

The Insurance Regulatory and Development Authority of India (IRDAI) has implemented the Integrated Grievance Management System (IGMS) as an online platform that enables policyholders to officially lodge their complaints against insurance companies. Through IGMS, policyholders have the capability to monitor the progress of their grievances and engage in direct communication with IRDAI.

What can the government do?

Conclusion

2-wheeler insurance policies play a critical role in ensuring financial security for two-wheeler owners in India. Whether you opt for mandatory third-party liability coverage or comprehensive insurance with a range of add-ons, having the right insurance policy is essential to protect your bike and yourself from unexpected events.As a responsible bike owner, it’s essential to understand the types of coverage, factors affecting premiums, and the claim process. Additionally, regularly renewing your policy ensures uninterrupted coverage and may also lead to valuable discounts through the No Claim Bonus (NCB) system.To sum it up, two-wheeler insurance represents a judicious investment to protect your motorcycle and offer you a sense of security as you navigate the streets of India.

One year following India’s ban on specific single-use plastic items, a recent study conducted by Toxics Link, titled “India’s Single-Use Plastic Ban,” has discovered the prevalent use of these prohibited plastic products in five major Indian cities – Delhi, Mumbai, Bengaluru, Guwahati, and Gwalior, notably in local stores and markets. Although certain single-use plastic products (SUPPs) were officially banned on July 1 last year, it seems that the enforcement of this ban remains largely ineffective. This evident violation casts serious doubt on India’s endeavours to reduce plastic pollution.

The worldwide production of plastic waste, totalling approximately 400 million tonnes annually, continues to pose a significant environmental challenge due to insufficient management capacity. At the core of this issue is the prevailing ‘take, make, use, and dispose’ model that characterizes the plastic economy, promoting the widespread use of SUPPs. This leads to the generation of vast quantities of non-biodegradable waste, often carelessly discarded and ultimately finding its way into landfills and oceans. Subsequently, this waste breaks down into micro- and nano-plastics, posing a grave threat to the entire ecosystem.

In an effort to address this problem, India implemented a ban on specific SUPPs nationwide from July 1, 2022, aiming to reduce the usage of products with low utility and high littering potential that harm the environment and public health. Nearly a year since the ban’s introduction, it is crucial to assess its effectiveness and understand the challenges in its implementation. This study sought to evaluate the ban’s implementation, analyse the availability of substitutes for SUPPs, and identify the obstacles to their adoption. The resulting report offers key recommendations to enhance compliance and achieve a substantial reduction in the use of SUPPs.

To evaluate the accessibility of SUPPs and their potential substitutes, surveys were conducted in five cities spanning different regions of India. Subsequently, interviews were conducted with relevant stakeholders to gain insights into the impediments hindering the transition to substitute products. The findings revealed that, of the five cities surveyed, Delhi exhibited the lowest level of compliance with the ban’s implementation, with banned SUPPs still accessible at 88% of the surveyed locations. In contrast, Bengaluru displayed the highest level of compliance, with SUPPs available at 55% of the surveyed points. Gwalior (84%), Mumbai (71%), and Guwahati (77%) also reported a substantial presence of SUPPs at the surveyed locations. This raises concerns as, nearly one year post-ban implementation, SUPPs continue to be available at more than half of the surveyed points in these five cities.

Though consumption of banned items has gone down, especially in branded sector, there is still large-scale use in many segments. The informal economy, largely, continues its SUPPs usage, especially plastic carry bags, cutlery, straws, etc. In-depth analysis of the collected data gives an insightful view and points out the SUPPs that have been affected by the ban and the ones that have suffered limited impact.

The most abundantly found SUPP in all cities was restricted carry bags (mainly plastic carry bags <120 microns); their average availability was as high as 64%. Similarly, SUPPs such as thermocol for decorations, balloon and earbuds with plastic sticks were widely available. This is highly disappointing as substitutes for these SUPPs are easily available in the market. On the positive note, use of plastic stirrers and plastic sticks in ice cream was not noted in any of the five surveyed cities. Another positive outcome is the reduction of plastic cutlery, straws, cups and plates in eating places.

The overall availability across cities for these SUPPs is below 30% while the availability of sustainable substitutes is higher. Another key point observed in the survey findings is availability of SUPPs and its correlation with location type. For example, street food (chaat) vendors, coconut sellers, vegetable vendors and small stalls in markets, weekly and wholesale markets do not comply with the ban in all five cities, but formal eating places, malls and metro stations mostly obey the ban. This probably indicates that ban compliance is driven by the economics and the degree of enforcement at a location; formal or branded locations that can afford substitutes and are monitored strongly under laws have to a large extent switched to substitutes. In comparison, a street vendor or a small shopkeeper are yet to switch to substitutes as they are weakly regulated and also because of the cost of substitutes. However, small, a price margin makes a substantial difference to them. Shopkeepers/ vendors also find the availability and their access to substitutes to be a challenge.

Another important factor that decides compliance appears to be consumer behaviour; many shopkeepers say that consumers demand SUPPs.

Regulatory agencies in one of surveyed state says that for the first year of the ban, the focus has been more on larger establishments and ensuring compliance there. Also, the attempt has also been to cut off supply. The issue of livelihood is also another factor to be considered, while being not so stringent in the informal economy, but the next phase is expected to focus on that. Another state agency points out the lack of economically feasible substitutes as a key factor.

Finally, the study presented recommendations based on the findings and stakeholder inputs. First, the enforcement and monitoring process needs to be stronger and uniform across locations. For this, the study suggests that, in addition to the regulatory agency increasing its vigilance, third monitoring could be helpful. Second, the study suggests that the availability of SUPPs can be reduced only when the supply of banned products is disrupted with effective monitoring at the manufacturing level. Regular checks are recommended at the manufacturing units.

Availability of economically and functionally feasible substitutes will need market-based policy tools to incentivise production and adoption. For instance, economic incentives should be provided to substitute manufacturers — raw materials for substitutes could be made tax free or subsidies added to make production cheaper. Additionally, training and skills needed for the incubation of substitute micro-enterprises should be conducted.

Last, stakeholder engagement should be fostered and inputs from all stakeholders regarding the bottlenecks should be incorporated in the implementation process. Since customers are one of the most important stakeholders, environmental education and regular campaigns should be used to increase awareness and reinforce ban-compliant consumer behaviour. The study proposes that the penalties collected while enforcing the ban should be used to conduct regular monitoring, awareness campaigns, skill development and distribution of substitutes to SUPPs.

Though malls and metro stations show strong adherence to the ban, the study finds that shopping markets, weekly markets, and wholesale markets have major enforcement gaps. Despite their controlled environments, plastic carry bags are also frequently used on railway platforms, bus depots, and tourist spots. Furthermore, despite the availability of viable alternatives, the continued presence of SUPPs in the food business, including restaurants, food stalls, and street food vendors in all cities, raises serious concern about the effectiveness of the product ban.

“Single-use plastics play a significant role in exacerbating the plastic pollution crisis, and the study’s findings highlight significant deficiencies in the ban’s enforcement in India, particularly within the informal economy. The unrestricted use and circulation of banned single-use plastics are alarming, and their open sale on e-commerce platforms is equally concerning,” remarked Priti Banthia Mahesh, Chief Programme Coordinator at Toxics Link. She emphasized, “While alternatives are accessible in the market, it is equally important to adopt a life cycle approach to assess these substitutes before their widespread adoption.”

In Delhi, one of the surveyed cities, significant usage of banned SUPPs has been noted during the study. In a shocking finding, the study reports that 100% of the surveyed vegetable shops, and markets, including wholesale and weekly, sweet shops, bus depots, and chaat shops in Delhi are providing restricted plastic carry bags, indicating its widespread usage and possible littering. Usage of plastic carry bags was very high in other points as well, including tourist spots and small restaurants. Disposable cups, straws, and plates, made of plastic, are available at 54%, 45%, and 43% of the points respectively, indicating a high volume of use. Thermocol for decorations, balloons, and earbuds with plastic sticks are available at almost all surveyed points in the city. The use of the banned products was seen in 100% of the food stalls and chaat vendors, coconut water sellers, grocery shops, markets, and bhandaras. Interestingly, SUPPs were absent in malls and ice cream parlours.

“It is important to recognise that while progress has been made, there is still a substantial journey ahead in curbing the prevalence of single-use plastic products in our cities. The varying levels of compliance across different locations and product types highlight the complexity of this challenge,” said Satish Sinha, Associate Director at Toxics Link. He adds, “Stakeholders must come together and build on the positive shifts observed while addressing the areas that require immediate intervention. Our goal is to cultivate a sustainable ecosystem that not only enriches our communities but also safeguards our planet.”

According to the survey data, SUPPs are still easily available across all five cities. Amongst the surveyed cities, Bengaluru is the most ban compliant with SUPPs in use at 55% survey points. Delhi is the least compliant city as 88% of survey points still provide SUPPs.

Table: Availability of different SUPPs in surveyed cities

| SUP Item | Bengaluru | Delhi | Mumbai | Guwahati | Gwalior | Overall |

|---|---|---|---|---|---|---|

| Restricted carry bags | 54% | 64% | 57% | 69% | 78% | 64.4% |

| Plastic cutlery | 12% | 45% | 21% | 40% | 30% | 30% |

| Plastic cups | 23% | 54% | 28% | 30% | 13% | 30% |

| Plastic plates | 10% | 43% | 5% | 7% | 31% | 19% |

| Plastic straws | 30% | 45% | 22% | 10% | 29% | 27% |

| Plastic wrapping film | 27% | 47% | Not available | 31% | 8% | 23% |

| Earbuds with plastic sticks | 25% | 90% | 43% | 40% | 100% | 60% |

| Candy with plastic stick | Not available | 33% | 67% | 30% | 17% | 30% |

| Balloon with plastic sticks | 22% | 92% | 100% | 67% | 20% | 60% |

| Ice-cream with plastic stick | Not available | Not available | Not available | Not available | Not available | 0% |

| Thermocol for decorations | Not available | 100% | 71% | 100% | 100% | 74% |

| Plastic stirrers | Not available | Not available | Not available | Not available | Not available | 0% |

| PVC banner (100 microns) | 25% | 60% | 67% | Not Available | 25% | 35% |

| Plastic flags | Not available | Not available | Not available | 100% | 100% | 40% |

*Source: Single-use plastic ban in India: A report by Toxics Link.

Crucial Approaches to enforce Ban

Enforcing a ban on single-use plastics poses a substantial challenge in India, a nation marked by diverse geographical, social, economic, and cultural landscapes. Research on a global scale underscores the necessity for a multifaceted approach when implementing such bans. Ideally, this approach should encompass a combination of legislative and non-legislative actions involving multiple stakeholders. While India’s ban on Single Use Plastic Products (SUPPs) represents an initial stride, the effectiveness of this ban hinges on several critical factors. Among them, the cost and accessibility of substitutes, public awareness and knowledge, and effective monitoring and enforcement take precedence. In the context of a diverse country like India, this endeavour becomes more arduous and requires a conscious and comprehensive strategy. Key strategies may revolve around the following considerations:

Effective monitoring and enforcement mechanisms

The difference in compliance levels across different location types and different cities is indicative of the gaps in enforcement. It is also important to note that most recognised and large brands have made the shift as larger corporations with a great degree of public visibility are monitored more closely by the enforcement agencies and are also more sensitive to damage in reputation. In comparison, smaller businesses have limited financial capabilities to adapt to legislative changes, but also have lesser monitoring. This uneven monitoring and enforcement can lead to shift in the burden, and not really reduce the problem. To ensure good governance, enforcement, and monitoring, it is important to clearly distribute and define roles and responsibilities between local and national regulatory agencies. Sustained monitoring efforts are needed, as the users tend to go back to the convenient option the moment the enforcement weakens. It is also important to use punitive measures as the prosecution of offenders will help ensure compliance to the policy and act as a deterrent for others. User fines can also be a deterrent used to discourage consumers from asking for banned SUPPs. It is important for regulatory agencies at state and national levels to keep the public updated on the progress and benefits achieved, in order to continue building consensus and demonstrate accountability. Third party evaluation in July 2022, when the single-use plastic ban came into effect, there was a flurry of activities, including regular checks by most state agencies. With the months passing by, these checks have gone down due to a lack of resources with the enforcement agencies. But, as stated above, for the ban to work well, there is a need for sustained enforcement effort. In the absence of resources at state regulatory agencies, some of these could be outsourced and institutions like civil society organisations (CSOs) and consultancy groups could play an important role in monitoring ban compliance. In these cases, it will be necessary to also provide them with certain authority to take actions against violators. Additionally, academic institutions, researchers or CSOs could be also roped in to evaluate the ban at a regular interval, in order to understand challenges or changes on ground.

Control on manufacturing

Use is only possible when there is a regular supply. And it is clear from the study that most of the banned SUPPs are still available in the market and their supply has been uninterrupted. Several measures ought to be taken to check usage and monitor vendors and consumers. But it is absolutely necessary to crack down on the manufacture of the prohibited products. Regular and random checks at manufacturing units could help curb the production of these items.

Research and Development

The lack of alternatives has been identified as a crucial barrier by most stakeholders interviewed during this study. Experts in this field have also, since the beginning of the ban, stressed the importance of availability of feasible alternatives. Ecofriendly and fit-for-purpose alternatives should provide the same or better properties of the items that are being regulated. The study findings clearly highlight that the switch has been much easier where there are feasible (both economically as well as functionally) alternatives, like in the case of cutlery or plates. But the cost difference or functionality has been a question for some products; for example, in carry bags or straws. Therefore, there is a need for further research and development to bring in substitutes that can be adopted by various stakeholders.

Support to substitutes

The cost of substitutes is one major bottleneck, especially for smaller vendors or small users. If cheap and resistant alternatives are unavailable, the ban can negatively impact the poorest segments of the population. The uptake of affordable, eco-friendly, and fit-for-purpose alternatives can be facilitated through the introduction of economic incentives (including tax rebates, research and development funds, technology incubation support and public- 79 private partnerships). For example, certain materials used to manufacture alternatives, such as sugarcane, bagasse, bamboo, paper, or corn starch, can be made tax-free. To stimulate the substitute’s eco-system through creation of micro-enterprises, training could be organised to impart knowledge on new skill-sets related to production and promotion of alternatives. When promoting the use of substitutes, the agencies need to also consider their environmental and life cycle impact. Also, the study results have also shown use of compostable bags or other SUPPs. Currently, these materials end up getting mixed with other household waste. It is vital to consider the impact of mixing these with regular waste stream and whether a separate collection mechanism is required, as many of these may have a different composting need than wet waste.

Assessing the sustainability of existing substitutes

Some research studies have pointed out that many substitutes available in the markets might not be entirely eco-friendly when assessed under Life Cycle Assessment (LCA). For example, a study has pointed out that substitutes like paper straws may contain toxic chemicals like perfluoroalkyl substances (PFAS) which are detrimental to health. Therefore, proper research needs to be conducted to assess the sustainability and health impacts of substitutes before adopting or promoting them.

Expanding the scope

Stakeholders, particularly waste workers, have shared insights during informal discussions, highlighting the presence of non-banned single-use plastic in the waste stream. Many of these items lack recycling potential or are impractical to collect and recycle. This observation underscores the necessity to reconsider the list of banned items in the single-use plastics ban, extending its scope to encompass other low-value, high-impact SUPPs. Potential additions might include small sachets (e.g., for shampoo, ketchup), petite mineral water bottles, plastic wrapping on various products (such as cosmetics, notebooks, handwash, shampoo), cling film used on fruits and vegetables, and plastic film used in dishwasher products. Conducting a comprehensive study to identify such SUPPs and explore viable alternatives becomes imperative for future action.

Coupling bans with other policy tools

Bans can also effectively be coupled with economic instruments, like increasing taxes on materials used for problematic SUPPs, subsidies for switching to more sustainable alternatives and tax reductions on substitute materials or levies for products containing recycled materials.

Foster stakeholder engagement

The single use plastic ban in the country has affected a wide range of stakeholders from different economic and social background. Hence, to improve compliance, it is important to have a larger acceptance from the broadest range of stakeholders. Though there were some consultations held when the ban came into force, but one year down the line, it is important to revive these consultations to focus on the bottlenecks and the measures needed to improve compliance levels. And these deliberations should not be limited to large industry players, but also extend to MSME and informal groups who have been identified in this study as groups which are the large users at this point. Public consultation through online surveys could be another way of reaching out to consumers, not just for creating awareness but to also understand their reasons for shifting or not shifting to alternatives (like carry bags).

Behavioural change campaigns

Raising public awareness through environmental education is a key element when enforcing a ban like this. Evidence shows that resistance is likely to decrease if consumers are aware of the social, environmental, and economic impact. Knowledge helps individuals make informed decisions, and may encourage environmentally sustainable behaviour. Though there were numerous initiatives when the ban came into effect in July 2022, the visibility of such campaigns has since reduced. Also, the campaigns were more focused on creating awareness and not always prompting change in practice. For enhanced public acceptance and compliance with SUPP bans, behavioural change campaign, for different target audiences and economic groups need to be designed and put into action. Social and mass media can be used effectively. This needs to be a sustained effort, because changing mindsets and behaviour requires time. In addition to this, reusable bags can be distributed for free at the entrance of some location types, where the usage of plastic bags is high. Using the fund from the fines for an effort like this can be beneficial in changing people behaviour.

Fund management

The usage of banned single use plastic products invites fines at present and it is important that due consideration is given to how the revenue from this economic instrument will be used. It will be useful if these funds are managed with transparency and utilised to make the ban more effective on ground.

This article is an extract of a report on ‘Single use plastic ban in India’ by Toxics Link. For the full report, please go to-

https://toxicslink.org/wp-content/uploads/2023/08/Single%20Use%20Plastic.pdf

Toxics Link is an Indian environmental research and advocacy organization set up in 1996, engaged in disseminating information to help strengthen the campaign against toxics pollution, and to provide cleaner alternatives. They also work on ground in areas of municipal, hazardous and medical waste management and food safety among others.