In India, owning a vehicle, whether it's a car or a two-wheeler, is a common aspiration. However, not everyone has the immediate financial means to...

How to save Tax

How to save Tax

In March, the fiscal year 2022–2023 will come to an end. Only on the basis of your annual savings will you receive a tax rebate. If you have a job, firms will start requesting investment documentation in December. These will determine whether or not tax deductions are made from your paycheck.

Tax deductions will increase if you don’t save, which will lower your take-home pay. The maximum salary will be paid to you if taxes are not withheld. There’s a chance you haven’t made an investment yet. If that’s the case, do it right away. We inform you of the investment programme that will be most profitable for you.

Subas Tiwari

However, it requires special planning. This is the New Year, so do your tax planning as soon as possible based on your financial goals. There are 17 ways through which you can reduce your tax liability including PPF, NSC and life insurance premium.

Unit Linked Insurance Plan (ULIP)

ULIP Life Insurance Plan is one of the most important investment plans in India. It ensures that one’s family is financially balanced in the case of an event of death. By purchasing a life insurance policy, the taxpayer can avail of the benefit under the income tax act.

Under section 80C of the income tax act 1961, the premium paid towards the purchase of a life insurance policy qualifies for deduction up to Rs. 1.5 lakh. Furthermore, as per section 10(10D), income on the maturity of the policy is tax free. The income is tax-free if the premium is not more than 10% of the sum assured. In the case wherein the money goes to the nominees of the person insured, the same remains as a tax exemption in the hands of the nominee.

In terms of the deduction under section 80C 1961, the taxpayer can claim 20% of tax deduction on the premium paid. The following conditions also apply:

- The taxpayer purchases a life insurance policy on or before 31st March 2012

- The policy is in his own name or in the name of their spouse or child

If the life insurance policy is purchased after 1st April 2012, then the premium paid is eligible for tax deduction up to 10% of the sum assured.

Equity Linked Savings Schemes (ELSS)

Equity Linked Savings Schemes are mutual fund investment schemes that invest a large percentage of their portfolio in equity. Furthermore, the fund has a mandatory lock-in period of 3 years which is the shortest amongst all the investment products.

Investment in ELSS funds qualifies for deduction under section 80C of the income tax act up to a maximum of Rs. 1.5 lakh. Both lump sum investment and the amount invested through a systematic investment plan (SIP) qualifies for the deduction. Since ELSS funds invest a large amount in equity, there is always some inherent risk.

ELSS funds provide the dual benefit of capital appreciation and tax-savings. This makes it one of the most popular tax saving schemes amongst investors.

In general, taxpayers who want to claim tax deductions of up to Rs 1.5 lakh under Section 80C provisions and are willing to take some risk should consider investing in ELSS. These mutual funds are equity-oriented, and they invest a minimum of 60% of their portfolio in equity and equity-linked instruments. This makes it crucial to be invested in the funds for a long period of time in order to reap the benefit of the returns.

Public Provident Fund (PPF)

The Public Provident Fund has always been a popular tax saving schemes amongst the taxpayer. One of the major reasons for this popularity is the fact that PPF falls under the category of exempt–exempt–exempt tax status. You can open your PPF accounts with a bank or post office.

Taxpayers can claim a deduction under section 80C of the income tax act for the amount invested by them during the financial year. The maximum amount eligible for deduction is Rs. 1.5 lakhs. Since PPF falls under the exempt category, the interest and maturity amount are exempt from tax.

PPF account comes with a lock-in period of 15 years and it allows the investors the below options at the end of the maturity period:

- Withdrawal of proceeds from the account

- Continue for another 5 years

(4) Sukanya Samridhi Yojana (SSY)

Sukanya Samriddhi Yojana has become one of the most important tax saving schemes. It was launched in 2015 by the government of India as a part of the Beti Bachao Beti Padhao campaign. It had a major impact on the general public. The scheme allows a fixed income investment through which the taxpayer can invest regular deposits and at the same time earn interest on it. Investing in Sukanya Samriddhi Yojana also qualifies as an eligible deduction under section 80C of the income tax act.

The government of India determines the rate of interest on the scheme on a quarterly basis and is payable on maturity. The scheme comes with a lock-in period of 21 years and will mature after the expiry of 21 years. A minimum deposit of Rs. 250 is required to be made per year for 15 years. Failure to pay the minimum amount in a year will lead to disconnection of the account. To re-activate the account, you need to pay a penalty of Rs. 50 along with the original Rs. 250 deposit.

In order to open a Sukanya Samriddhi account, below is the eligibility criteria for this tax saving option:

- Only girl children can claim the benefits of this scheme.

- The girl child cannot be more than 10 years of age. A grace period of one year is provided which allows the parent to invest with 1 year of the girl child being 10 years of age.

- The investor must submit age proof of the daughter.

(5) National Savings Certificate (NSC)

A government of India initiative, a national savings certificate is a fixed income investment scheme that aims at the small and middle-income investors to invest and earn handsome returns. It is considered a low-risk investment and as secure as the Provident Fund. The investors can invest as per their income profile and investment habits.

Investment in NSC qualifies for deduction under section 80C of the income tax act up to Rs. 1.50 lakh. Apart from providing the benefit of tax exemption, it provides the investor with complete capital protection and guaranteed interest. Some of the features of the NSC, tax saving option are as follows:

- 8% annual interest as a guaranteed return.

- You can claim a tax benefit under section 80C up to Rs. 1.5L.

- You can invest as low as Rs. 1,000 (or multiples of Rs. 100). You can increase the investment amount as per your convenience.

- On maturity, the entire maturity value will be received by the investor and the same will be taxed in the hands of the taxpayer.

- An early exit is not available. You can use the same as collateral security in case of loans from Bank or NBFC.

(6) Tax-Savings Fixed Deposit (FD)

Fixed deposits are considered one of the safest tax savings schemes. It’s safer than equity investments in terms of risk and returns. The banks decide the interest rates and it depends on several factors. Below are some of the features of a tax-saving fixed deposit:

- Investment in tax saver fixed deposit eligible for deduction under section 80C while calculating the taxable income.

- A minimum lock-in period of 5 years

- Senior citizens can get a higher interest rate on investment

- In the case of a joint account, the primary holder can avail the benefit of tax deduction while calculating the taxable income

- Tax saver fixed deposits do not allow any premature withdrawal. However, after the expiry of the 5 year lock-in period, investors get access to premature withdrawal. The terms and conditions for premature withdrawal vary from bank to bank.

(7) Senior Citizen Savings Scheme

A Senior Citizen Savings Scheme is an income tax saving schemes available to senior citizens who are residents in India. The scheme is available for investment through banks and post offices and offers one of the highest rates amongst the various savings schemes.

Depositors can make an investment with a minimum amount of Rs. 1000 and in multiples thereof. The scheme also provides the facility of investment through cash provided the investment amount is less than Rs. 1 lakh. The deposits made into the scheme matures after a period of 5 years. The depositors also have the option to further extend the maturity period by another 3 years.

Investment in the Senior Citizen Savings Scheme qualifies as a deduction under section 80C up to Rs. 1.5 lakhs from the taxable income. The interest on such deposits is fully taxable and liable for a tax deduction if the interest is above Rs. 50,000. Deposits made into a Senior Citizens Savings Scheme account are compounded and paid out annually.

(8) School Tuition Fees

The income tax act 1961 provides a deduction under section 80C of the income tax act for payment for school fees of children. This tax saving option is available under section 80C in addition to other investments like PPF, NSC, ELSS, etc. Tuition fees paid to any registered university, college, school, or educational institution qualifies for deduction up to Rs. 1.5 lakh.

Moreover, only the tuition fees qualify for deduction under the income tax act. Any other fee like donation, development fee, etc. even if paid to such an institution does not qualify for the deduction.

The income tax act allows both the parents to claim the deduction to the extent of the amount paid by them. So if the total fee paid by the parents is Rs 1 lakh, of which the father has paid Rs 40,000, while the mother has paid Rs 60,000, both can claim the amount individually as per the payment made by them.

(9) National Pension Scheme (NPS)

NPS or National Pension Scheme has become a popular income tax saving investment product. It is a tax saving option that is available to both government and private employees. It enables the depositor to build a corpus for their retirement along with a regular monthly income. The amount invested by the depositor is invested in several schemes including the equity markets.

There are two types of NPS accounts, Tier-1 & Tier-2. A tier-1 account has a lock-in period until the subscriber reaches the age of 60 years. The contributions made by the subscriber to tier-1 are tax-deductible under section 80CCD (1) and 80CCD (1B). Tier-2 accounts are voluntary in nature which allows the subscriber to withdraw the money when they like. However, contributions under tier-2 accounts are not eligible for a tax deduction.

As per the provision of section 80CCD, an individual can claim a deduction up to Rs. 1.5 lakh by investing in NPS. Additionally, a new sub-section 1B was also introduced, which offered an additional deduction of up to Rs. 50,000/-for contributions made by individual taxpayers towards the NPS.

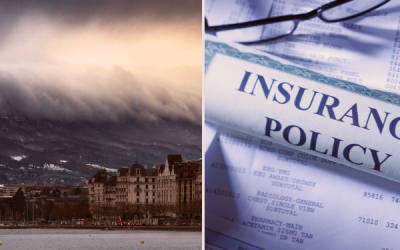

(10) Health Insurance premium under section 80D

You can claim a tax benefit up to Rs. 25,000 in respect of the below contributions:

- Premium paid to keep in force health insurance covering self, spouse, or dependent children.

- Any contribution to Central Health Government Schemes.

- Any other scheme may be notified by the central government as eligible for deduction.

In order to take care of one’s medical emergencies, medical insurance is considered the safest investment option. This allows the taxpayer to avail of the benefits on two fronts. Firstly, being taken care of by the insurance policy in the case of a medical emergency. Secondly, the tax benefit under the income tax act for investing in an investment product.

Apart from the above, an additional deduction for the insurance of the parents is available to the extent of Rs. 25,000 if they are less than 60 years of age or Rs. 50,000 if they are more than 60 years of age. If the individual and the parent are both above 60 years of age, the maximum deduction available under this section will be Rs. 1, 00,000.

Summary of the deductions that are available under various categories:

| Expenditure | Expenditure made for | Eligible Deduction |

| Amount paid to keep in force eligible health insurance. Contribution towards Central Health Government Scheme Expenditure towards preventive health check-up |

Self, spouse, and dependent children For (b) & (c), if the age of the above persons is above 60 years of age and they are resident in India |

Rs. 25,000 Rs. 50,000 |

| Amount paid to keep in force eligible health insurance. Preventive health check-up | Parents If the age of the above persons is above 60 years of age and they are resident in India |

Rs. 25,000 Rs. 50,000 |

| Amount paid on account of medical expenditure for self/spouse/parents who are of the age of 60 and above, being a resident in India, and no payment has been made towards the health insurance |

Rs. 50,000 |

(11) Education Loan

The income tax act provides a tax benefit on repayment of the loan as a tax deduction under section 80E of the act. You must remember that this tax saving option is available to the person who is repaying the loan. Once an educational loan is availed, the interest paid on the education loan qualifies for a tax deduction for a maximum of 8 years, or the interest is repaid, whichever is earlier.

Depending on who pays the EMI for the education loan, the parent or the child can claim the deduction. The deduction under section 80C is available only if you take the loan from a financial institution and not family members. You can claim the tax deduction starting from the year in which the repayment starts.

The income tax authorities provide a moratorium period of up to one year to the borrower from the date of completion to start repaying the loan. This allows the taxpayer sufficient time to manage their finances and claim the deduction once they start repaying the loan.

For example, if the taxpayer repays their education loan in 5 years from the date of repayment, the tax deduction would be available for this 5 year period only. As per section 80E, this benefit can be claimed for a period of 8 years so the taxpayers should avail this benefit. Borrowers should note that their repayment may exceed 8 years, but in such cases, they won’t get the tax deduction under Section 80E beyond the 8th year.

(12) Rent paid and no HRA received

Generally, you receive HRA as a part of your salary and treat HRA as a major tax saving schemes while filing income tax returns. However, there can also be a case wherein it does not form part of the salary of the employee. In such a case, standard HRA deduction cannot be claimed and the taxpayer would not be able to claim the benefit even if they are paying the rent. Further, in such cases, a taxpayer must claim a tax benefit under section 80GG.

In order to provide the taxpayer with benefit even in a case where HRA is not received, section 80GG was introduced. As per this section, a taxpayer can claim the deduction of rent paid even in a case wherein they do not receive HRA. This is subject to the below conditions:

- The individual is self-employed or salaried.

- HRA has not been received at any time during the year for which deduction is being claimed under section 80GG.

- You, your spouse, or the HUF in which you are a member does not hold any residential accommodation at a place where you currently reside.

To claim deduction under section 80GG, you must file form 10BA for payment of rent. The lower of the below will be considered as a deduction under this section:

- 5,000 per month.

- 25% of the total Income (excluding long-term capital gains, short-term capital gains under section 111A and Income under Section 115A or 115D and deductions under 80C to 80U.

- Actual rent less 10% of Income

(13) Interest paid on Home Loan

In order to claim the interest component on a housing loan as a tax deduction, you must satisfy the following conditions:

- A home loan must be taken for the purchase or construction of a house.

- Construction of the house must be completed within 5 years from the end of the financial year in which the loan was taken.

- The interest component paid as a part of the loan can be claimed as a deduction under section 24 up to Rs. 2 lakh. This is applicable in the case of a self-occupied property. In the case of a let-out property, there is no upper limit for claiming interest.

- In the case of interest being paid towards a home loan taken during a pre-construction period, the pre-construction interest paid can be claimed as a deduction. The deduction is available in five equal installments starting from the year in which the property is acquired or construction is completed. However, the maximum limit is Rs. 2 lakh.

(14) Savings bank account interest

The income tax act 1961 provides deductions with respect to interest earned from savings bank accounts. Individuals and Hindu undivided family can claim the tax deduction under section 80TTA on the interest earned. This deduction is applicable to taxpayers other than those who are senior citizens. In the case of senior citizens, section 80TTB is applicable.

The maximum deduction under section 80TTA is Rs. 10,000. The limit of Rs. 10,000 applies to the total interest earned from the savings bank account that the assesse has. Any interest over and above Rs. 10,000 is taxable under “Income from Other Sources”. The rate of tax will be as per the applicable tax slab rate. For example, the total interest earned by Amit from his savings bank account was Rs. 15,000. In this case, the total exemption allowed under section 80TTA will be Rs. 10,000 and the balance Rs. 5,000 will be taxable as “income from other sources”

On 1st April 2018, section 80TTB came into existence for senior citizens. As per section 80TTB, senior citizens can claim deduction up to Rs. 50,000 or an amount specified from the total gross income.

(15) Medical expenses towards disabled dependent

As per the provisions of section 80DD, a taxpayer can claim a deduction if they are looking after disabled dependents. This tax benefit will help in reducing the tax liability of the person who is taking care of someone disabled in the family who is dependent on them.

As per section 80DD, disabled dependents include spouses, children, parents, or siblings (brother or sister). In the case of HUF, a disabled dependent may be a member of the Hindu undivided family. In order to claim tax benefits under section 80DD, a deduction should not have been taken under section 80U. Below are a few of the disabilities:

- Blindness

- Low vision

- Hearing impairment

- Mental illness

- Autism

Medical expenses against which you can claim tax benefits are as follows:

- Any expenditure made towards medical treatment, nursing, training, rehabilitation of a dependent person with a disability.

- Any amount paid as a premium for a specific insurance policy designed for such cases as long as the policy satisfies the conditions mentioned in the law.

(16) Treatment of specified diseases u/s 80DDB

A deduction under section 80DDB is allowed to a taxpayer wherein a case they have contracted diseases such as cancer, neurological diseases such as dementia, motor neuron disease, Parkinson’s disease, AIDS, etc. All such disease entails expensive treatment costs and the expenses done can be claimed as a deduction under section 80DDB.

The deduction under section 80DDB is allowed for the medical treatment of a dependent who is suffering from a specified disease by individuals or HUF. The deduction is up to ₹ 40,000 or the amount actually paid (whichever is lower). This limit goes to ₹ 1 lakh in the case of senior citizen taxpayers or dependents.

(17) Donations made to charitable institutions

Section 80G provides a tax deduction to the taxpayer with respect to the amount paid by them to an approved charitable organization. The donations made to such organizations should be made via cheque or online transfer. Cash transfers, above Rs. 2,000 do not qualify for deduction under this section. It is very important to take the stamped receipt from the organization wherein the donation has been made in order to claim the deduction.

Depending on the type of organization where a donation has been made, the tax deduction under section 80G can be either 50% or 100% of the donation amount. However, the same is restricted to 10% of the adjusted gross total income of the taxpayer. An adjusted gross total income can be defined as:

- The gross total income (sum of income under all heads) minus

- Amount deductible under Section 80CCC to 80U (but not Section 80G), minus

- Exemption from income, long-term capital gains, minus

- Income as referred under Sections 115A, 115AB, 115AC, 115AD, and 115D, relating to non-residents and foreign companies.

There are basically four buckets in which donations can be categorized to claim the tax deduction.

- Donations with 100% deduction without any qualifying limit, such as the National Defence Fund set up by the Central Government.

- Donations with a 50% deduction without any qualifying limit such as the Jawaharlal Nehru Memorial Fund or the Prime Minister’s Drought Relief Fund

- Donations with 100% deduction subject to 10% of adjusted gross total income. The donation must be towards a Government or any approved local authority, institution, or association to be utilized for the purpose of promoting family planning

- Donations with 50% deduction subject to 10% of adjusted gross total income such as any institution which satisfies conditions mentioned in Section 80G(5).

Income Tax Rates

| Individuals | ||

| (Other than senior and super senior citizen) | ||

| Net Income Range | Rate of Income-tax | |

| Assessment Year 2023-24 | Assessment Year 2022-23 | |

| Up to Rs. 2,50,000 | – | – |

| Rs. 2,50,000 to Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% |

| Senior Citizen | ||

| (who is 60 years or more at any time during the previous year) | ||

| Net Income Range | Rate of Income-tax | |

| Assessment Year 2023-24 | Assessment Year 2022-23 | |

| Up to Rs. 3,00,000 | – | – |

| Rs. 3,00,000 to Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% |

| Super Senior Citizen | ||

| (who is 80 years or more at any time during the previous year) | ||

| Net Income Range | Rate of Income-tax | |

| Assessment Year 2023-24 | Assessment Year 2022-23 | |

| Up to Rs. 5,00,000 | – | – |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% |

| Hindu Undivided Family (Including AOP, BOI and Artificial Juridical Person) | ||

| Net Income Range | Rate of Income-tax | |

| Assessment Year 2023-24 | Assessment Year 2022-23 | |

| Up to Rs. 2,50,000 | – | – |

| Rs. 2,50,000 to Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% |

Income Tax Rates- Sourced from- https://www.incometaxindia.gov.in on 07th Dec 2022