Liquid funds are short termed income schemes that invest in money market instruments such as government securities, treasury bills among others. If...

Things you should know about Application Supported by Blocked Amount (ASBA)

Things you should know about Application Supported by Blocked Amount (ASBA)

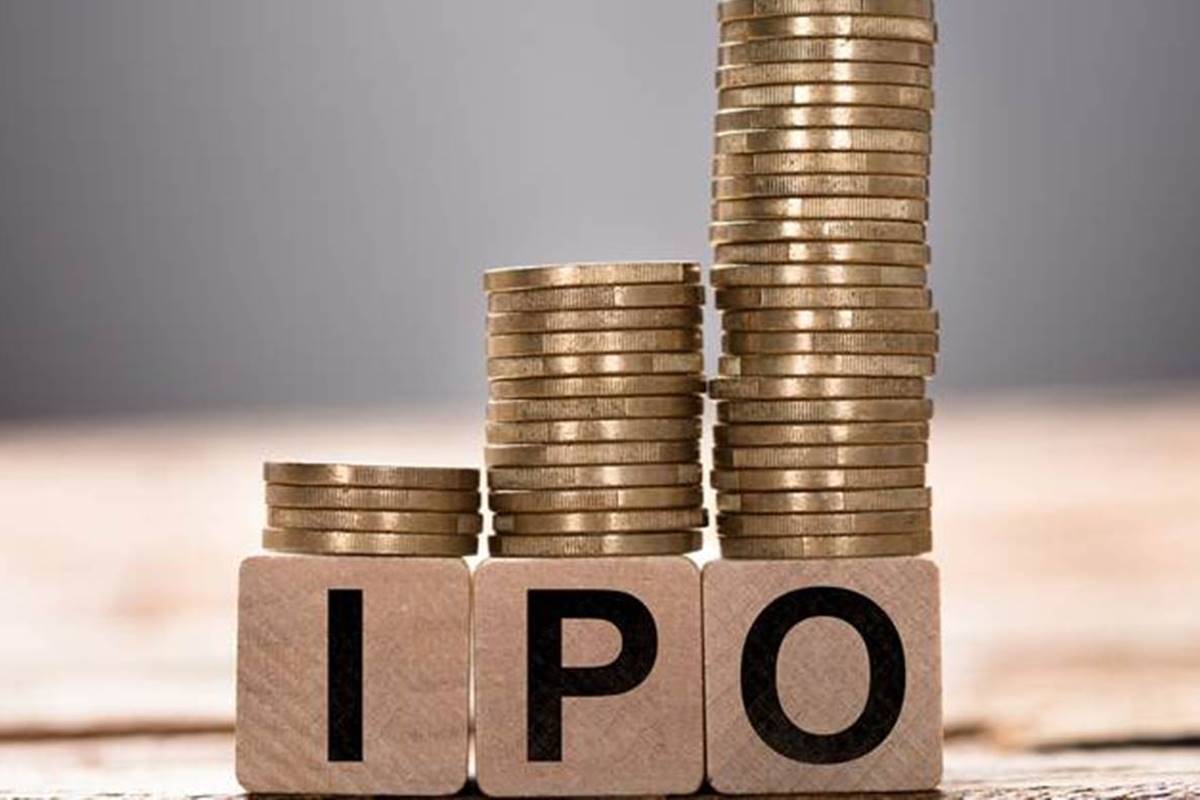

With the Zomato IPO in the headlines, you might want to know how to subscribe an issue in the Initial Public Offering or IPO. If you’re so, we suggest you to understand what is an Application Supported by Blocked Amount (ASBA). It is a process developed by India’s Stock Market Regulator SEBI for applying to IPOs, Rights issue, FPS etc. In ASBA, an IPO applicant’s bank account doesn’t get debited until shares are allotted to them. Let us understand what it entails here and what a consumer needs to go though.

Subas Tiwari

ASBA facility is adopted for application of Initial Public Issue IPO and Follow-on Public Offer (FPO). It is a SEBI based facility on your bank account which was launched in May 2010. It is a process by which retail investors block the relevant amount in their savings account till the shares are allotted, to apply for investment in an IPO or FPO. If shares are allotted to you then this amount is deducted from your bank account otherwise it is unblocked after the allotment process is completed. It can also be understood that if the investor has subscribed for the IPO, then under the process money will not be deducted from the investor’s account until he gets the IPO issue.

ASBA or Application Supported by Blocked Amount is an application containing an authorization to block the application money in the bank account, for subscribing to an issue.

If an investor is applying through ASBA, his application money shall be debited from the bank account only if his/her application is selected for allotment after the basis of allotment is finalised, or the issue is withdrawn/failed.

Detailed procedure of applying in IPO through ASBA

Under ASBA facility, investors can apply in any public/rights issues by using their bank account. Investor submits the ASBA form (available at the designated branches of the banks acting as Self-Certified Syndicate Banks) after filling the details like name of the applicant, PAN number, de-mat account number, bid quantity, bid price and other relevant details, to their banking branch by giving an instruction to block the amount in their account. In turn, the bank will upload the details of the application in the bidding platform. Investors shall ensure that the details that are filled in the ASBA form are correct otherwise the form is liable to be rejected.

Who can apply through ASBA facility?

SEBI has been specifying the investors who can apply through ASBA. In public issues with effect from May 1, 2010, all the investors can apply through ASBA.

In rights issues, all shareholders of the company as on record date are permitted to use ASBA for making applications provided he/she/it:

- is holding shares in dematerialised form and has applied for entitlements or additional shares in the issue in de-materialised form;

- has not renounced its entitlements in full or in part;

- is not a renounce;

- who is applying through blocking of funds in a bank account with the Self Certified Syndicate Bank (SCSB).

Applying through ASBA vis‐à‐vis applying with a cheque

Applying through ASBA facility has the following advantages:

- The investor need not pay the application money by cheque; rather the investor submits ASBA which accompanies an authorisation to block the bank account to the extent of the application money.

- The investor does not have to bother about refunds, as in ASBA only that much money to the extent required for allotment of securities, is taken from the bank account only when his application is selected for allotment after the basis of allotment is finalised.

- The investor continues to earn interest on the application money as the same remains in the bank account, which is not the case in other modes of payment.

- The application form is simpler.

- The investor deals with the known intermediary i.e. its own bank.

Is it mandatory for investors eligible for ASBA, to apply through ASBA only?

No, it is not mandatory. An investor, who is eligible for ASBA, has the option of making the application through ASBA or through the existing facility of applying with cheque.

Can I make application through ASBA facility in all issues?

Yes, you can make application through ASBA facility in all the issues (i.e. public and rights. List of Self Certified Syndicate Banks (SCSBs) and their designed branches i.e. branches where ASBA application form can be submitted, is available on the websites of BSE (www.bseindia.com) and NSE (www.nseindia.com) and on the website of SEBI (www.sebi.gov.in). The list of SCSBs would also be printed in the ASBA application form.

Self-certified Syndicate Bank (SCSB)

SCSB is a bank which is recognised as a bank capable of providing ASBA services to its customers. Names of such banks would appear in the list available on the website of SEBI. No, ASBA can be submitted to the SCSB with which the investor is holding the bank account. Five (5) applications can be made from a bank account per issue.

You can either fill up the physical ASBA form available with SCSB and submit the same to the SCSB or apply electronically/online through the internet banking facility (if provided by your SCSB).

Can I use the existing application form for public issues?

Investor is requested to check the form carefully. In case of public issue, the application form for ASBA will be different from the existing application form for public issues. The application forms will be available with designated branches of

SCSB. In case of rights issue, there will not be a separate form for ASBA. The investor has to apply by selecting ASBA option in Part A of the Composite Application Form.

How to withdraw my ASBA bids

During the bidding period you can approach the same bank to which you had submitted the ASBA and request for withdrawal through a duly signed letter citing your application number, TRS number, if any. After the bid closure period, you may send your withdrawal request to the Registrars before the finalisation of basis of allotment, who will cancel your bid and instruct SCSB to unblock the application money in the bank account after the finalisation of basis of allotment.

What to do when application gets rejected

You have to approach the concerned SCSB for any complaints regarding your ASBA applications. SCSB is required to give reply within 15 days. In case, you are not satisfied, you may write to SEBI thereafter.

It is to keep in mind that in ASBA, the entire bank account does not get blocked. Only the amount to the extent of application money authorised in the ASBA will be blocked in the bank account. The balance money, if any, in the account can still be used for other purposes.

If the withdrawal is made during the bidding period, the SCSB deletes the bid and unblocks the application money in the bank account. If the withdrawal is made after the bid closure date, the SCSB will unblock the application money only after getting appropriate instruction from the registrar, which is after the finalisation of basis of allotment in the issue.

And investors need not necessarily have their DP account with the SCSB, where they are submitting the ASBA form. One is required to submit ASBA to the SCSBs only.

An investor can apply either through ASBA or through existing system of payment through cheque. If an applicant applies through both, ASBA as well as non‐ASBA then both the applications having the same PAN, will be treated as multiple application and hence will be rejected.

The bids received through ASBA mode gets reflected in the demand graphs displayed in the website of stock exchanges. In case there is an error by SCSB in entering the data in the electronic bidding system of the stock exchanges, the SCSB shall be responsible.

The SCSB shall give a counterfoil as an acknowledgement at the time of submission of ASBA and also the order number, generated at the time of uploading the application details, if sought by the investors in case of need.

ASBA forms need to be treated similar to the non‐ASBA forms while finalising the basis of allotment. In case the issue fails/withdrawn the SCSB shall unblock the application money from the bank accounts upon receiving instructions from the registrar.

In case of any complaints, the investor shall approach the bank, where the application form was submitted or the registrars to the issue.

This can be done provided that your bank have core banking facility and the ASBA form is submitted at a branch which is identified as designated branch by the bank.

The chance of getting allotment is same for all the applicants whether application is made through ASBA or non‐ASBA. ASBA is a simple, easy and smart way of applying in public issues. There are many advantages of applying through ASBA like money does not go out of investors’ account, no hassle of refund, investor keep earning interest on the blocked amount as banks have started paying interest on daily basis w.e.f April 1, 2010 and it gives better opportunity for utilisation of money.

ASBA forms can be submitted only at the SCSBs. In case investor does not have an account with any of the SCSBs, then he cannot make use of the ASBA.

(Source: SEBI)

Related

Pros and Cons of Liquid Mutual Fund

All you need to know about Infrastructure Mutual Funds (MF) Investments

Infrastructure mutual funds are mutual funds that invest in the infrastructure sector or its ancillary companies that own, manufacture and operate...

What are Liquid Mutual Funds?

What are Liquid Mutual Funds?Liquid funds are mutual funds that invest your money in short-term market instruments such as treasury bills,...