No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

People from all walks of life are enthralled by the yearly budget every year. This year, the government’s main focus is on fiscal consolidation, with the goal of bringing the budget deficit down to 5.1% in FY-25—a considerable decrease from 5.8% in FY-24. The significant 11% growth in capital expenditure, which totalled an astounding Rs 11.11 lakh crore in FY-25, is the main engine of economic progress.

The goal of this budget is to enhance physical, social, and digital infrastructure in a comprehensive manner. In order to guarantee formalization and financial inclusion, the Digital Public Infrastructure (DPI) plays a significant role. There are aggressive measures in place to control inflation and promote active economic growth in all areas, and the tax base expansion through the GST is expected to deepen and broaden.

The “Strategy for Amrit Kaal” represents inclusive development, emphasizing the advancement of four major castes: the ‘Garib’ (poor), ‘Yuva’ (youth), ‘Mahilayen’ (women), and ‘Annadata’ (farmer). To guarantee that the effects of policies are felt all the way to the end, the government is making serious efforts. A million households will receive up to 300 units of free power each month as part of the Rooftop Solarization project.

In a bold move towards sustainable practices, the budget emphasizes ‘LiFE’ – Lifestyle for Environment, with a commitment to achieving “Net-zero” carbon emissions by 2070. Special projects for port connectivity, tourism infrastructure, and amenities are slated for islands, including Lakshadweep.

The Nari Shakti scheme has disbursed 30 crore Mudra Yojana loans to women entrepreneurs, encouraging initiatives like “Cervical Cancer Vaccination” for girls aged 9-14. Recognizing the potential of youth, the government has sanctioned 43 crore loans under PM Mudra Yojana, fostering entrepreneurial aspirations.

The budget places a strong emphasis on implementing the National Education Policy, with a focus on subsequent job creation and business support. The establishment of 30 Skill India International Centres opens doors to international opportunities, and the National Apprenticeship Promotion Scheme offers stipend support to 47 lakh unemployed youth.

In summary, India’s Budget Highlights 2024 demonstrate a strategic vision ready to support both social and economic advancement. Together with targeted investments, the government’s commitment to budgetary restraint creates the conditions for a vibrant and sustainable economic trajectory. These fiscal policies, which address both short-term issues and long-term goals, aim to move India toward a better future as the country navigates difficulties.

We extend our heartfelt gratitude to our esteemed readers for their unwavering support. Your engagement, feedback, and ideas play a pivotal role in our mission to deliver informative articles. Share your thoughts and suggestions at info@consumer-voice.org, as together, we foster a knowledgeable and empowered community.

Wishing you an enriching and enjoyable reading experience ahead!

Pallabi Boruah

Editor

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

In the diverse and vibrant landscape of India, consumer-related issues have emerged as a critical facet of daily life. As the nation progresses economically and the consumer market expands, individuals face a range of challenges that demand attention and proactive measures. From product quality concerns to unfair business practices, addressing these issues is vital for ensuring a fair and secure marketplace for all.

Pallabi Boruah

One of the primary consumer problems in India revolves around product quality and safety. Instances of substandard goods entering the market pose significant risks to consumers. To tackle this issue, regulatory bodies need to enforce stringent quality control measures, conduct regular inspections, and penalize businesses that compromise on the safety and quality of their products.

Misleading Advertising and Marketing Practices

Consumers often fall victim to misleading advertising and marketing practices, leading to uninformed purchasing decisions. Regulatory authorities must strengthen advertising standards and penalize businesses engaging in deceptive practices. Additionally, fostering consumer education to enhance awareness about discerning marketing tactics can empower individuals to make more informed choices.

E-commerce Challenges

Due to the rapid expansion of e-commerce in India, customers now have to deal with particular issues such misrepresented products, delayed delivery, and return policy disagreements. To protect consumer interests in the digital marketplace, strong laws tailored to the e-commerce industry must be put into place. Transparent communication must also be ensured, and dispute resolution procedures must be streamlined.

Price Gouging and Unfair Trade Practices

Unfair trade practices and price gouging often leave consumers at a disadvantage. Stringent regulations against exploitative pricing, collusion, and unfair business practices are imperative. Consumer protection agencies should actively monitor and penalize entities engaging in such practices to maintain a fair and competitive market environment.

Consumer Education Initiatives

Consumer education plays a pivotal role in addressing and preventing issues. Implementing comprehensive educational initiatives, both at schools and through public awareness campaigns, can equip individuals with the knowledge needed to protect their rights, make informed decisions, and navigate the complexities of the consumer market.

Strengthening Consumer Grievance Redressal Mechanisms

A robust system for addressing consumer grievances is crucial. Strengthening consumer grievance redressal mechanisms, both online and offline, ensures that individuals have accessible channels to report issues and seek resolution. This includes enhancing the efficiency of consumer forums and creating user-friendly online platforms for complaint registration.

Empowering Consumer Protection Laws

The legal framework governing consumer protection must evolve to address contemporary challenges effectively. Regular updates to consumer protection laws, consideration of international best practices, and strict enforcement are vital to create a legal environment that prioritizes consumer welfare.

Addressing consumer problems in India requires a multifaceted approach involving collaboration between government bodies, regulatory authorities, businesses, and consumers themselves. By implementing and reinforcing these measures, India can create a consumer-friendly environment that safeguards individual rights, promotes fair business practices, and fosters a culture of transparency and accountability in the marketplace. As the nation progresses, prioritizing consumer protection is not just an ethical imperative but also a strategic move towards building a robust and sustainable economy.

Imagine a bag of chips. The label might list a serving size as 28 grams, but let’s be honest, who stops at just that? That’s where portion size comes in. It’s the amount of food you choose to eat, which can be more or less than a serving size. Think of a serving size as a standardized measurement, while your portion size is a personalized decision. Packaged foods – so handy, so tempting! They help us grab-and-go, but their sneaky serving sizes and clever marketing can trick us into eating more than we need. That’s where mindful eating comes in – paying attention to our hunger and munching mindfully. In this article, we talk about the influence of food portions.

Richa Pande

Factors like gender, age, and hunger impact how much we eat, but our minds also play tricks on us. Our plates are more than just containers; they’re influenced by a mix of psychology and biology. Visual cues, plate size, and optical illusions can make us think a plate is emptier than it is. Emotions, social pressure, and marketing further affect our food and portion choices.

My Plate, designed by the Indian Council of Medical Research (ICMR), offers recommended food guidelines and portion sizes tailored to the unique dietary requirements and cultural nuances of India. Familiarizing oneself with these food groups can contribute make mindful food choices. The plate’s suggested proportions guarantee sufficient intake of various micronutrients, including vitamins and minerals, as well as bioactive compounds, functional foods, antioxidants, and other essential nutrients.

| Food groups | Foods to be consumed raw weight (g/day) | % of Energy from each food group/ day | Total Energy from each food group/ day (Kcal) | Total protein from each food group/ day (g) | Total Fat from each food group/ day (g) | Total Carbs from each food group/ day (g) |

| Cereals (incl. Nutri cereals) | 250 | 42 | 843 | 25 | 5 | 172 |

| Pulses* | 85 | 14 | 274 | 20 | 3 | 42 |

| Milk/ Curd (ml) | 300 | 11 | 216 | 10 | 13 | 16 |

| Vegetables* green leafy vegetable (GLV) | 400 | 9 | 174 | 10 | 2 | 28 |

| Fruits | 100 | 3 | 56 | 1 | 1 | 11 |

| Nuts & Seeds | 35 | 9 | 181 | 6 | 15 | 6 |

| Fats & Oils | 27 | 12 | 243 | – | 27 | – |

| Total | 1200 | – | 2000 | 15% of Total Energy Intake | 30 % of Total Energy Intake | – |

Table: Food Groups & Recommended Portions, My Plate for the Day, ICMR NIN

Packaged foods offer undeniable convenience, but going through the recommended serving size is important before picking the portion of that food product. The “serving size” listed on labels is the recommended portion you should be having. Consider it a starting point, like a map rather than a definitive destination. Your ideal portion, the one that truly nourishes and satiates, will depend on your unique needs and circumstances. While packaged options are tempting, preparing meals at home offers greater control over portion sizes. Opt for smaller plates and bowls. This visual trick can trick your brain into feeling satisfied with smaller portions, promoting both physical and mental well-being. Avoid distractions while eating. Put down your phone, turn off the TV, and focus on the sensory experience of savouring each bite. This helps you appreciate the taste, texture, and aroma of your food, preventing mindless overconsumption. Don’t skip meals in the hopes of “saving calories” for later snacks. Instead, fuel your body consistently with balanced meals and mindful snacks throughout the day. This avoids hunger pangs that can lead to impulsive overeating.

seeks to provide a thorough understanding of the intricacies surrounding personal loans offered In the rapidly expanding financial landscape of India, Non-Banking Financial Companies (NBFCs) have become pivotal players, particularly in the realm of personal loans. This comprehensive guide by NBFCs in India, delving into the application process, features, advantages, challenges, and the impact on borrowers.

Subas Tiwari

NBFCs, or Non-Banking Financial Companies, are financial institutions that offer banking services without meeting the legal definition of a bank. Unlike traditional banks, NBFCs cannot accept demand deposits but play a crucial role in providing credit, including personal loans.

To comprehend the significance of personal loans by NBFCs, it is essential to trace the historical evolution of these entities in India. Originally established as investment institutions, NBFCs have transformed into diversified financial service providers, offering a broad spectrum of products, with personal loans being a key component.

The regulatory framework governing NBFCs is a critical aspect of their functioning. The Reserve Bank of India (RBI) serves as the primary regulatory authority overseeing NBFC operations. These regulatory guidelines ensure the stability of the financial sector and safeguard the interests of consumers.

Personal loans offered by NBFCs come with distinctive features tailored to meet the diverse financial needs of individuals. Notable features include:

NBFCs offer various types of personal loans to cater to specific needs, including:

Comparing personal loans from NBFCs with traditional banks reveals distinct differences such as:

One significant advantage of choosing an NBFC for a personal loan is the expedited application processing. NBFCs typically employ streamlined processes, leveraging technology to facilitate quick approval and disbursal.

Unlike traditional banks, NBFCs often have more lenient eligibility criteria. This flexibility allows individuals with varying credit profiles and financial histories a higher chance of approval for a personal loan from an NBFC.

Understanding the diverse financial needs of individuals, NBFCs offer customized personal loan products. This flexibility empowers borrowers to choose loan amounts, tenures, and repayment schedules aligning with their financial goals.

While NBFCs offer competitive interest rates, borrowers must be aware of potential fluctuations in interest rates, impacting the overall cost of the loan.

Like any financial institution, NBFCs face risks related to credit, market dynamics, and operational aspects. Effective risk management practices are crucial for maintaining a stable and sustainable lending portfolio.

Compliance with regulatory guidelines is a critical aspect of NBFC operations, ensuring consumer protection and the overall stability of the financial sector.

In recent years, NBFCs have embraced digitalization to enhance service delivery. This includes online application processes, digital documentation, and electronic fund disbursal.

The integration of data analytics and credit scoring algorithms has become prevalent in the NBFC sector, enabling efficient risk assessment and informed lending decisions.

Financial literacy is crucial for borrowers to make informed decisions, understanding terms and conditions, interest rates, and repayment obligations for responsible borrowing.

Consumers have specific rights when availing personal loans. Regulatory bodies play a vital role in ensuring NBFCs adhere to consumer protection measures, fostering a fair and transparent lending environment.

The future of NBFC personal loans is marked by emerging trends, including innovations in product offerings, technology integration, and a focus on customer-centric solutions.

NBFCs are likely to engage in collaborations with other financial institutions and fintech companies, fostering competition and driving further innovation in the personal loan sector.

This comprehensive guide has explored the multifaceted landscape of personal loans offered by NBFCs in India. From understanding the role of NBFCs to dissecting the features, advantages, challenges, and the impact on borrowers, the guide serves as a roadmap for individuals navigating the terrain of personal finance.

In conclusion, the personal loan landscape in India is evolving, with NBFCs playing a pivotal role in meeting the diverse financial needs of the population. As borrowers continue to seek financial solutions, being informed about the options, risks, and benefits of NBFC personal loans is essential for making sound financial decisions. This guide aims to empower individuals to navigate the financial landscape confidently, leveraging the opportunities presented by NBFCs for personal financial growth.

Check for Online Application: Many NBFCs offer online application processes, making it convenient and efficient. Explore institutions with user-friendly digital platforms for a seamless application experience.

|

NBFCs |

Interest Rate |

Processing Fee |

|

Muthoot Finance |

14% p.a. onwards |

Up to 3.5% |

|

Tata Capital |

10.99% p.a. onwards |

Flat Rs 51 |

|

Bajaj Finserv |

11% p.a. onwards |

Up to 3.93% |

|

StashFin |

11.99% p.a. onwards |

Up to 10% |

|

Faircent |

9.99% p.a. onwards |

Up to 8% |

|

Kreditbee |

Up to 29.95% p.a. |

Up to 6% |

|

Navi Finserv |

9.9% – 45% p.a. |

Nil |

|

Money Tap |

12.96% p.a. onwards |

|

|

Dhani Loans |

13.99% p.a. onwards |

3% onwards |

|

Money View |

1.33% per month onwards |

Starting from 2% |

|

Pay Sense |

1.4%-2.3% per month |

Up to 2.5% |

|

Fibe |

16% p.a. onwards |

Up to 3% |

|

Home Credit |

24% p.a. onwards |

Up to 5% |

|

CASHe |

27% p.a. onwards |

Up to 3% or Rs 1,200 |

|

HDB Financial Services |

12%-31% p.a. |

Up to 3% |

Interest Rates and Processing Fees rates are sourced from- https://www.paisabazaar.com as of 24th November 2023

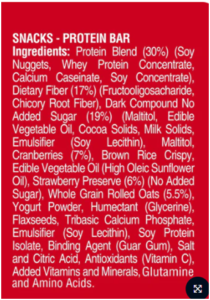

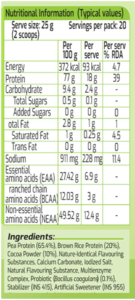

As I navigated the bustling supermarket aisles, my attention was drawn to the vibrant array of NutriBars lining the shelves. Each bar boasted enticing claims, from “high protein” to “low sugar”, but the sheer variety and conflicting messages left me feeling overwhelmed. One bar touted its all-natural ingredients, but it had a 16 grams of sugar per serving. Another claimed to be a “meal replacement,” but its nutritional profile resembled a candy bar more than a balanced meal. The confusion was palpable, and I knew I wasn’t alone in this dilemma. With so many options to choose from, how could one make an informed decision about which NutriBar was truly the healthiest? This article discusses NutriBars in detail and offers some tips to make healthier and better choices

Richa Pande

NutriBars offer a convenient and nutritious solution to fuel your busy lifestyle. These portable snacks are packed with wholesome ingredients that provide essential nutrients for sustained energy and overall well-being. NutriBars are typically made with a combination of whole grains, nuts, seeds, fruits, and sometimes added protein or fibre. These ingredients provide a balance of carbohydrates, protein, healthy fats, and fibre, keeping you satiated and energized throughout the day.

Navigating the world of NutriBars can be difficult, given the vast array of options available. To make informed choices and maximize the benefits of NutriBar consumption, consider these essential tips:

Before diving into the world of NutriBars, it’s crucial to establish your primary objective for consuming them. Are you seeking a quick energy boost to fuel your active lifestyle? Aiming for sustainable weight loss by choosing low-calorie and satiating options? Or striving for muscle gain by incorporating protein rich NutriBars into your diet? Understanding your specific goals will guide your NutriBar selection and optimize their effectiveness. You can consult a registered nutritionist / dietitian for guidance.

Pick bars that have ingredients like whole grains, nuts, seeds, and dried fruits. These ingredients offer a wealth of nutrients and fibre, promoting overall health and well-being. Avoid NutriBars laden with excessive added sugars, artificial sweeteners, and food additives that can detract from their nutritional value.

Pick NutriBars with a protein content of at least 8-15 grams per serving. Protein plays a pivotal role in satiety, muscle growth, and post-workout recovery. Consuming adequate protein helps you feel fuller for longer, supports muscle maintenance and repair, and enhances athletic performance. You can pick bars that contain soy, pea, and whey, nuts and seeds.

Seek NutriBars containing at least 3-5 grams of fibre per serving. Fibre serves as a gut health champion, promoting digestive regularity, fostering the growth of beneficial gut bacteria, and contributing to prolonged satiety. Incorporating fibre rich NutriBars into your diet can help you feel fuller for longer, regulate bowel movements, and support overall digestive health. Consider NutriBars enriched with prebiotics, such as chicory root inulin or Fructooligosaccharides (FOS). Prebiotics act as food for beneficial gut bacteria, promoting their growth and enhancing digestive health. Prebiotic-rich NutriBars can help improve nutrient absorption, boost immunity, and support overall gut microbiome balance.

Be mindful of sugar content when choosing NutriBars. Opt for options with less than 10 grams of added sugar per serving to minimize sugar intake and prevent blood sugar spikes. Excessive sugar consumption can contribute to weight gain, energy crashes, and increased risk of chronic health conditions.

While NutriBars offer convenient nutrition, it’s essential to have them in moderation. Mindless overconsumption of any food, including NutriBars, can lead to excess calorie intake, hindering health goals and potentially contributing to other health concerns.