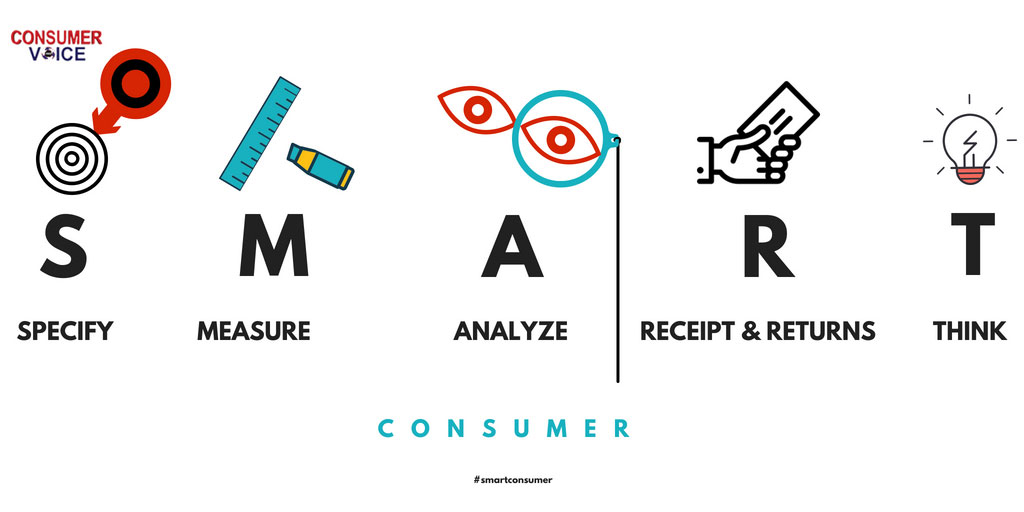

Are you a SMART Consumer ?

You want value for money but at times because of marketing gimmicks, end up taking a hasty decision to buy products or services that are not needed or don’t have the desired features or are simply below the standards. It is worse if you did not check the return policy or simply did not bother to have a bill. Hence a SMART Consumer is the one who buys best products or services as per requirements and knows how to protect oneself from any problem thereafter.

HERE’S A SMARTER WAY TO MAKE INFORMED CHOICES!

Specify: You should know the purpose of your purchase. Answer all the possible Ws – Why do you need this product or service? Who is going to use it? Where do we keep it? Etc.

Measure: Once you know the purpose of the purchase, fix a criterion. Make a check list of all the features and functions. This will help to narrow down your choices from the excessive variety of products that are available. You can measure the importance of each feature so that you can prioritize the ‘Must Haves’.

Analyse: Once you are armed with the checklist, it’s time to do the Market Analysis.

- Prefer a registered retailer or a licensed service provider

- Compare Prices and Features included

- Check Ratings and Reviews of the sellers, resellers and online aggregators

Receipts and Returns: Receipts are critical in case of local or unregistered sellers. Don’t fall prey to ‘without a bill-cash payment’ culture prevalent in India or be ready to lose all the guarantees or warrantees. A definitive Return Policy has become critical with online sales replacing the brick and mortar shops. A policy, that not only guarantees money back but there are no deductions too.

Think Tank: If you have diligently reached SMAR, there is a little chance of you taking a wrong decision but if it happens due to the malpractices of the retailers, manufacturers and service proviers, you have to be a think tank who when faces problems knows the solutions and they are:

Related

Decoding Cyber Coverage in India: Your Ultimate Guide

In today's technology-driven landscape where digitalization is ubiquitous, companies confront an escalating threat landscape in the form of...

Navigating Insurance Options: Comprehensive Coverage for Diabetics in India

As the prevalence of diabetes continues to rise steadily in India, individuals grappling with this chronic condition encounter myriad challenges,...

Understanding International Travel Insurance

International travel insurance serves as a financial product crafted to shield travellers from unforeseen events and expenses while journeying...