IRCTC Travel Insurance for E-Ticket Travellers

IRCTC Travel Insurance for E-Ticket Travellers

Who cares about buying travel insurance for rail travel? That too when one can get insurance coverage of up to ₹10 lakh at a premium of 35 paise for financial protection against rail accidents and other untoward incidents including robbery.

You might have overlooked it, but Indian Railway Catering and Tourism Corporation (IRCTC) has been providing you insurance every time you book a ticket through its website or mobile app. While booking tickets for your train journey on IRCTC site, you will get an option on “Travel Insurance” where you can choose whether you want travel insurance or not. Since the cost is only 35 paise, it is advisable to choose this one.

Subas Tiwari

Rail Travel Insurance Covered

Rail travel insurance provides coverage of Rs 10 lakh for death and permanent total disability arising out of any train accident or other untoward incident. 7.5 lakh is available for permanent partial disability. 2 lakhs coverage is available for hospitalization expenses for injury. Accidents, robbery, and other violent acts during train travel are covered by the policy. Insure for yourself & family when you book your tickets by train. It is simple & easy. No hassles of medical test, filling up of forms, etc.

Indian Railway Catering and Tourism Corporation (IRCTC), a Subsidiary of the Ministry of Railways, Government of India has floated this unique concept in rail travel in India, which is inviting raves amongst the travelling public for offering additional rail safety for train travellers.

As a pilot exercise, this scheme is open only to those who book travel tickets on online platforms (through e-tickets). Now, let us get down to understand what the scheme is & how does it extend rail insurance cover.

Who are covered?

- All resident Indians and NRIs who booked online through NGet (New Generation E-Ticketing) website application of IRCTC only

- All Indians above 5 years of age

- All who have booked train tickets on online platforms (e-ticket)

- All those who require Tatkal & Premium Tatkal train tickets through online booking

- All those travelers who have confirmed/RAC tickets of any class (II, AC 2 tier, AC 3 tier, etc.) & who actually board the train to travel on the fateful day

What is the premium payable?

The premium amount is Rs.0.35 paise per passenger (inclusive of all taxes). However, there are conditions attached to this premium. That is, if you opted for this travel insurance, then it will be compulsory for all passengers booked under the single PNR. Also, in the case of ticket cancellations, the premium charged would have to be forfeited & would not be refunded.

Amount of coverage

- The scheme offers travellers or their family’s compensation of up to Rs 10 lakhs in the event of death or permanent total disability (and Rs 10,000 for transportation of mortal remains in the event of death in a train accident).

- Rs 7.50 lakhs for permanent partial disability (and Rs 10,000 for transportation of injured person(s) in a train accident.

- Upto Rs 2.00 lakhs for hospitalization expenses (the coverage for Hospitalization Expenses for Injury is over and above the death/permanent total disability/partial disability).

The above is applicable on a train accident or other ‘untoward incident’ including terrorist attacks, dacoity, rioting, shoot-out or arson, as well as for short termination, diverted route and Vikalp trains. Further claims under train accident and untoward incident cases will be as per definition under Sections 123 read with Sections 124 and 124A of the Railways Act, 1989.

Which Insurance Companies are covering this Risk?

IRCTC offers Rail Insurance cover in partnership with the following General Insurance Companies (under Personal Accident Cover)

- SBI General Insurance

- Bharti Axa General Insurance

- Bajaj Allianz General Insurance

- Shriram General Insurance

- ICICI Lombard Insurance

- Royal Sundaram General Insurance

- Liberty General Insurance, etc.

Rail customers shall receive the policy information through SMS and on their registered email IDs directly from insurance companies along with the link for filling nomination details. However, policy number can be viewed from ticket booked history at IRCTC page.

After the booking of ticket, the nomination details are to be filled at the respective insurance company site. If nomination details are not filled, then the settlement has to be made with legal heirs, if the claim arises.

However, the following are the terms & conditions governing the insurance cover-

- Insurance policies are contractual obligations between the insurance company & the passenger. In case of the passenger opting for insurance, the claim/liability shall be between passenger and the insurance company.

- The insurance company is responsible for policy issuance and claims settlement.

- All the correspondence by policy holder should be made directly with the insurance company on their toll free number, official E Mail IDs or offices as mentioned in the policy document. No correspondence is to be made with IRCTC in this regard.

- IRCTC only provides linkage to transact with insurance company through its website to take insurance cover and as such assume no responsibility or liability in respect of said policy, under any circumstances.

The Policy document would be issued as a soft copy to your registered email ID.

What are the Exclusions?

- Intentional self-injury, suicide or attempted suicide, whilst under the influence of intoxicating liquor or drugs.

- Arising or resulting from the Insured, committing any breach of law with criminal intent while crossing the railway tracks.

- Due to mental disorders or disturbance of conscious, strokes, fits or convulsions which affects the entire body.

- Radiations, infection, poisoning except where arise from accident, whilst engaging in any sort or form of adventurous sport or directly or indirectly caused or contributed by congenital anomaly, venereal disease, sexually transmitted disease, AIDS or insanity.

- Any congenital internal or external diseases, defects or anomalies.

- Any costs relating to the Insured’s pregnancy, childbirth or the consequences of either.

- Any costs in any way related to psychiatric or mental disorders.

- Dental treatment or surgery of any kind, unless to sound natural teeth and necessitated by an accident or untoward incident.

- Plastic or cosmetic surgery, unless this is certified by the attending medical practitioner.

- Claim in instances wherein ticket was booked by the Insured; however, the ticket was not confirmed but still the passenger boarded the train.

- Claim in instances wherein ticket was booked by the Insured; however, the train was not boarded. This is irrespective of whether the train ticket was cancelled or not.

The above-listed exclusions are not exhaustive.

Who are not Covered?

- Children below 5 years of age

- Citizens of foreign countries

- Those who have not opted for rail insurance cover

- Those who do not have confirmed train travel tickets

- Those who are on wait-list & unreserved rail tickets

Settlement of Claims

- The Insured or his nominee or legal heir shall deliver to the nearest office of the respective insurance company, not later than 4 months from the date of occurrence of the insured event, a detailed statement in writing as per the claim form and any other material particular, relevant to the making of such claim.

- The Insured or his nominee or legal heir shall tender to the insurance company all reasonable information, assistance and proofs in connection with any claim hereunder.

- The claim documents should be sent to the claims department of the nearest office of the insurance company through which this insurance is affected. List of the address of the office of the insurance company can be obtained from the website of the insurance company.

- Benefits payable under this policy will be paid within 15 days of the receipt of the last necessary document.

- No claim is admissible beyond 365 days from date of expiry of the policy in respect of hospitalization commencing within the period of insurance.

Advantages

- It assures the rail passenger of maximum safety of life while in travel.

- The premium is affordable by the common rail passenger.

- The insurance cover will help financially compensate at least in part, the physical loss of the deceased or of grievous injuries.

- The identity of the rail passenger can be quickly confirmed in case of a train accident, as the IRCTC has already captured all the personal information of the passenger in their website.

- Financial compensation in case of death/injury is quite reasonable.

- Left to the rail passenger to arrange for accident insurance for the period of travel, no insurance company would come forward to effect insurance cover.

Limitations

- IRCTC rail insurance is not available for travel in Suburban/Metro trains.

- As a pilot scheme, IRCTC has not included offline passengers, who form the majority of rail passengers requiring travel safety.

- All classes of passengers ( Second Class Chair Car, Sleeper Class, AC I Class , AC 2 Tier, AC 3 Tier, non/AC Chair Car, etc.) are treated equally without giving weightage for class of travel.

- The insured amount is not flexible in that those rail passengers who seek higher insurance cover are deprived of this facility.

- Those rail passengers who could afford to pay a higher premium are not offered the option.

- Rail passengers do not enjoy choosing their preferred insurance company amongst the 3 companies under IRCTC tie-up. Whichever company is insuring your passage, you will have to stick with it.

- Presently, in online ticket booking, the particulars of “NOMINEE” are not captured at the time of issuance of tickets, but subsequently get updated by calling for such particulars after a lapse of time. If the e-ticketing passenger does not respond to the particulars sought, then such updation of nominee does not get registered with IRCTC.

What could be in store?

According to unconfirmed sources, it is understood that the scheme could be liberalized to include all rail travellers based on customer feedback on success of the existing scheme, thus paving the way for secured & safe rail travel in India.

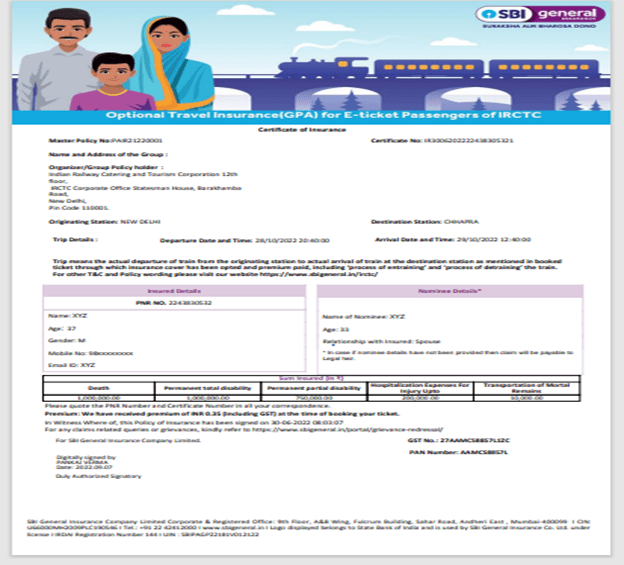

FORMAT OF IRCTC RAIL INSURANCE POLICY CERTIFICATE

Related

Decoding Cyber Coverage in India: Your Ultimate Guide

In today's technology-driven landscape where digitalization is ubiquitous, companies confront an escalating threat landscape in the form of...

Navigating Insurance Options: Comprehensive Coverage for Diabetics in India

As the prevalence of diabetes continues to rise steadily in India, individuals grappling with this chronic condition encounter myriad challenges,...

Understanding International Travel Insurance

International travel insurance serves as a financial product crafted to shield travellers from unforeseen events and expenses while journeying...